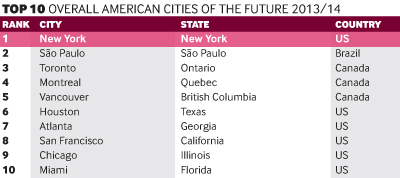

Uncertainty characterises the current global economic climate. With a 16% decline in FDI in 2012, investment agencies are facing greater competition to attract FDI projects. Yet New York has remained a top global destination for FDI, and was named as fDi Magazine’s American Cities of the Future 2013/14, with São Paulo coming in second and Toronto in third.

American Cities of the Future 2013/14

Join the conversation about the rankings on Twitter, use the hashtag #ACOF13

Advertisement

New York, the global hub of international business and commerce, grabbed the title for the second time in a row. Despite a knock or two, the city has continued to show its strength in surviving disasters both economic (Wall Street bail out) and natural (Hurricane Sandy). The city remains one of the world’s top destinations for investors, attracting 1.08% of global FDI. The total number of FDI projects into New York increased in 2012 with figures up 10.4% on the previous year.

But a South American competitor is nipping closely at its heels. For the first time in fDi Magazine’s bi-annual rankings, the Brazilian city of São Paulo has not only entered the top 10, but it ranked second overall, just ahead of Toronto. São Paulo is a key player in the global FDI arena, reaching sixth place worldwide in 2012, and attracting 1.19% of FDI projects. FDI into the city has increased year on year since 2004, according to greenfield investment monitor fDi Markets, which is part of the same division of the Financial Times as fDi Magazine, fDi Intelligence.

Canadian cities Toronto, Montreal and Vancouver ranked third, fourth and fifth, respectively, and performed particularly well in the attraction of knowledge-intensive FDI. All three locations were among the top 20 key destination and source cities for FDI. With the exception of New York, Montreal-based companies invested in more FDI projects than other city in the Americas region.

US cities made up the remainder of the top 10, with Houston, Atlanta, San Francisco, Chicago and Miami ranking sixth to 10th, respectively. San Francisco and Houston experienced the largest growth in FDI projects behind São Paulo and New York. Relative to population size, Atlanta and Miami were in the top five for attracting FDI.

São Paulo wins in Latin America

São Paulo has been named the Latin American City of the Future 2013/14, pushing the previous winner, Santiago (Chile), into second position, and leaving fellow Brazilian metropolis Rio de Janeiro ranking third.

Advertisement

According to fDi Markets, São Paulo and Rio de Janeiro have been the top two destinations for FDI in the Latin American region since 2011. Combined, the cities attracted a total of 16% of all FDI into the region in 2012. As Brazil prepares to play host to two major upcoming sporting events, the FIFA World Cup in 2014 and the Rio de Janeiro Olympic Games in 2016, the country's government has pledged that 2013 will be a year of major infrastructure development which, in turn, should act as a catalyst in enabling São Paulo, Rio de Janeiro and other Brazilian cities to build on their FDI success.

One disadvantage for investors locating in São Paulo is the relatively high costs, with Brazil’s corporation tax rate viewed as unattractive compared with neighbouring countries. Chile, for example, has been able to combine lower costs with a stable and prosperous business environment. One of the few global success stories of 2012, Chile is proof of the strong link between tax rates and FDI. In 2012, FDI into Chile increased by 25%, and the country’s 20% corporation tax rates makes it one of the lowest in the region. Chile’s capital city, Santiago, also benefits from significantly lower rental costs in contrast with many major cities, which contributed to its gaining second position in the Latin American Cities of the Future list.

Five new entrants featured in this year’s Latin American top 10 cities: Rio de Janeiro, Buenos Aires, Mexico City, Panama City and Montevideo. Buenos Aires climbed to fourth position, attracting investments from the Canadian company Research In Motion (RIM) – the developer and manufacturer of the Blackberry smartphone – and the German vehicle manufacturer Daimler. RIM’s new innovation centre is the company’s first such facility in Latin America, while carmaker Daimler’s $170m expansion of its manufacturing facility will produce vehicles under the Mercedes-Benz brand for the Latin American market.

Colombia’s capital, Bogotá, claimed fifth position in the Latin American ranking, and the city enjoyed some of the highest FDI growth across North and South America. Colombia’s strategy to rebrand the country and build a positive international image to potential investors appears to be paying off, and FDI into Bogotá has increased year on year since 2008. Having signed a free-trade agreement with the US in 2012, Colombia’s aim should be to capitalise on this opportunity, which could boost the potential for future exports and investments.

Monterrey (Mexico) and San José (Costa Rica) were ranked in sixth and seventh place, respectively, with new appearances from Mexico City, Panama City and Montevideo completing the top 10 Latin American Cities of the Future 2013/14.

São Paulo's economic potential rise

São Paulo has snatched the top position from New York to claim the title of Best Major American City for Economic Potential. According to data compiled by fDi Benchmark (a location assessment tool also owned by fDi Intelligence), São Paolo performed better than New York in regards to both GDP and FDI growth. Although FDI into Brazil declined, São Paulo witnessed a 4% increase in 2012 and attracted 10% more FDI than New York.

Demonstrating its entrepreneurial instincts, an increase in patents granted to inventors helped place San Francisco third in economic potential among major cities. The year 2012 signified Toronto’s best for FDI since fDi Markets records began in 2003. Ranking fourth for economic potential, Toronto was a key destination in the region, with FDI up 40% in 2012.

San Jose, California, the largest city within the world-renowned Silicon Valley, was named Best Large American City for Economic Potential. Home to some of the world’s most cutting-edge companies, San Jose continues to attract global investors, and exhibits strong patent and GDP growth figures. Canadian cities Vancouver and Calgary followed in second and third, respectively, registering the top FDI figures among large cities. Both locations have maintained a year-on-year growth since 2009.

This year, fDi Magazine introduced a new ‘Mid-Sized City’ category. Saltillo in Mexico was the top-performing mid-sized city for economic potential across North and South America, with strong GDP growth helping to entice investors. Automotive-related investments included a new manufacturing plant by the US-based IMMI, and a $500m expansion of existing manufacturing facilities by the Chrysler Group. Mississauga in Canada, which is home to more than 60 of the Fortune 500 companies, ranked second in economic potential in the mid-sized category, with Salt Lake City (the US) placing third.

Sunnyvale, California, is named as the Best Small City for Economic Potential again this year. Also located within the Silicon Valley area, Sunnyvale’s attraction as a destination is enhanced by the presence of global companies such as Yahoo! and Advanced Micro Devices, which are headquartered in the city. With strong R&D capabilities and high GDP growth, the city is positioned ahead of Durham in North Carolina.

Of the micro cities analysed, Heredia in Costa Rica had the best economic potential. Heredia attracted 24 FDI projects between 2006 and 2012, of which more than one-third were involved in manufacturing activities. Waterloo in Canada experienced the greatest growth in FDI of the micro cities, placing it second, with the US city of Wilmington, Delaware, in third.

Boston – the student magnet

Boston ranked as the Best Major American City for Human Resources 2013/14. Given its close proximity to world-class universities such as Harvard and the Massachusetts Institute of Technology, Boston has branded itself as a student magnet. New York followed Boston in second, with Washington, DC, and Atlanta claiming third and fourth place respectively. Nine of the top 10 consisted of US cities, with the only Canadian city, Toronto, placed in 10th position.

Minneapolis had the best offering of human resources among the large cities analysed, with the highest proportion of its labour force educated to tertiary level (53%), followed by Austin in second. Portland, Seattle and Denver completed the top five.

Salt Lake City topped the human resources category among mid-sized cities. Salt Lake City enjoys a highly educated workforce, thanks to the local University of Utah, which ranks among the world’s top 100 universities. Its attractive labour market combined with good quality of life should continue to attract investors. Second place belongs to the city of Raleigh, North Carolina. Lying in close proximity to the 'Research Triangle' that is home to R&D-related organisations such as IBM and Cisco Systems, Raleigh is viewed as an attractive destination due to its quality of life, educational offerings and the cluster of highly reputable companies in the region.

Ann Arbor, Michigan, has been awarded the Best Small City for Human Resources. Of the 422 cities analysed by fDi Magazine, it was shown to have one of the most educated workforces, of which almost three-quarters have reached tertiary level education. The University of Michigan employs about 30,000 people, and is a major keystone of the city. Investors are attracted to the area as a result of the university’s R&D activities and its graduates. According to fDi Markets, almost two-thirds of FDI into Ann Arbor was invested in R&D. Irvine, California, and Fort Collins, Colorado, followed Ann Arbor, in second and third place among small cities.

Of the micro cities, Waterloo, Canada, has topped the human resources category. Sited within Canada’s 'Technology Triangle', Waterloo boasts the largest presence of students out of the micro cities analysed. According to fDi Markets, Waterloo has attracted R&D investments from both Google USA and Mahindra Satyam, India. Gahanna, Ohio, and Bismarck, North Dakota, took the respective second and third spots.

Latin American cities prove cost effective

The Peruvian capital of Lima has been named as the Best Major American City for Cost Effectiveness 2013/14. Figures from fDi Benchmark indicate that wage costs in Lima are among the lowest of major American cities, cementing its top position. Following a decade of record-high growth, Peru’s economy has remained strong and resilient despite the global economic difficulties. Asian demand for copper and gold, combined with increased consumer spending from the emerging middle class, has aided an annual GDP growth in Peru of 6.7% (October 2012). Lima has been a key player driving this economic growth. According to its American Cities of the Future submission, the private investment promotion agency Proinversión states that Lima is now responsible for 50% of Peru’s total production.

The Chilean capital, Santiago, claimed second place in cost effectiveness. Its performance in this year’s rankings is boosted by the country’s low corporation tax rates, as well as low costs associated with importing and exporting. It was followed in third place by Quito, Ecuador, whose low office rental costs, low wages and cheap petrol prices have contributed to its rise in position from the previous ranking.

The title of Best Large American City for Cost Effectiveness 2013/14 has gone to Panama City. By comparison with other large cities across the Americas region, Panama City enjoys both low wages and low costs for imports and exports. A key driver of the success experienced in the city is the Panama Canal, which links the Pacific and Atlantic oceans. A project to expand the canal, combined with the 2012 enforcement of the free-trade agreement with the US, is expected to boost and extend economic growth in Panama City for some time.

Asunción in Paraguay ranked second behind Panama City, with San Luis Potosi, Mexico, claiming third. The remainder of the large cities in the cost-effectiveness category was made up of Mexican cites, enforcing the country’s position as a low-cost production haven. In 2012, Mexico ranked fourth globally for manufacturing FDI projects after the US, China and India, attracting almost 5% of global manufacturing FDI.

Among the mid-sized cities in the cost-effectiveness category, Peru, Chile and Mexico dominated, with Peru’s Piura at the top, followed by Chile’s Valparaíso and Trujillo, Peru, in second and third, respectively. Cuenca in Ecuador was the best small city in terms of cost effectiveness. Atlacomulco in Mexico came top among the micro cities.

New York retains infrastructure title

New York has once again been named Best Major American City for Infrastructure. Its major airports connect passengers to more than 127 international destinations, its renowned subways carry over 1.5 billion commuters each year, and it is home to one of the biggest ports in the world. Although aspects of the city’s infrastructure struggled in the wake of Hurricane Sandy in late 2012, according to the American Cities of the Future submission by the New York City Economic Development Corporation, the city has adopted an aggressive series of strategies to transform its physical infrastructure to maintain global competitive advantage. In the latest adopted budget, New York made five-year capital commitments to infrastructure, totalling about $40bn. San Francisco and Houston took second position among major cities in the infrastructure category, with both cities benefiting from major air and sea transport links.

The coastal sea port of Seattle topped the category for best infrastructure among large cities. Home to the ninth largest port in North America in terms of container handling, Seattle continues to be a major gateway for trade with Asia. San Jose, California, and Vancouver, Canada, followed Seattle in second and third position, respectively. Although ranked sixth in this year’s infrastructure category, Jacksonville, Florida, has implemented a strategy that focuses on its key strengths in logistics. In its American Cities of the Future submission, Jacksonville has adopted the strap line: 'America’s logistic centre', promoting its strategic geographic location – with its access to major ports, three major interstates, three major railroads and an international airport – in anticipation of increased port traffic as a result of the Panama Canal expansion.

Of the smaller city winners in the infrastructure category, most are located in close proximity to major ports and airports in neighbouring cities. Oakland and Long Beach – both in California – claimed the top two positions in the mid-sized category, benefiting from the transportation links offered by Los Angeles and the surrounding area. New Jersey’s Elizabeth and Newark and New York’s Yonkers ranked as the top three small cities with the best infrastructure; all are situated within a 32-kilometre radius of New York. Wilmington, Delaware, had the best infrastructure of the micro cities, benefiting from its position within the metropolitan area of Philadelphia.

Business-friendly Canada

A sound financial system, relatively low corporation tax rates and an open and affluent economy have resulted in Canadian cities dominating the category for business friendliness across all city sizes. However, a high concentration of top global companies, top world banks and continued expansion of existing FDI activities have helped New York win the award of Best Major American City for Business Friendliness 2013/14. Of the Financial Times’ Global 500 companies, 25 were headquartered in New York, along with 14 of the world’s top 1000 banks, according to The Banker magazine's annual ranking.

Coming in second, Toronto’s business-friendly environment is encapsulated in Invest Toronto’s American Cities of the Future submission, which states: “When stable, transparent financial and regulatory systems combine with a society that enjoys some of the most advanced freedoms in the world, it creates an environment for success.” Placed in third, Montreal’s success lies in retaining and developing relationships with existing investments – data from fDi Markets shows that one in five FDI projects since 2003 were expansions.

With virtually no restrictions on foreign investment, low corporation tax rates and high levels of economic freedom, Santiago in Chile was ranked the fourth most business-friendly city across the Americas region, and the top in Latin America among major cities. Santiago utilises this advantage to encourage potential investors, as is evident in its American Cities of the Future submission: “Santiago is viewed today as a haven for foreign capital in times of crisis due to its characteristics: security and transparency, as well as its competitiveness and excellent business projections.”

Canadian cities were awarded top positions for business friendliness in various city size categories: Vancouver ranked top of the large cities, with Mississauga top of the mid-sized cities. Victoria came top among small cities, and Waterloo was positioned just ahead of Delta in the micro cities.

Montreal tops strategy list

The prize for Best Major American City for FDI Strategy 2013/14 is awarded to Montreal. It beat 126 competitors across North and South America who submitted information regarding their FDI strategies. In its American Cities of the Future submission, economic development agency Montréal International stated that its economic development strategy has centred predominantly around high-tech clusters, and in particular aerospace, life sciences and health technologies, as well as information and communications technology (ICT). Elie Farah, vice-president of Investment Greater Montréal, says: “The year 2011 was one of the best for Montréal International in terms of attracting FDI since 2005. This is partially explained by the investments from Europe which, in the past two years, have become the main source of FDI in the region.”

Toronto has taken second place for FDI strategy, and its submission points to the city’s role as a major player in the North American market. It said: “Toronto is the financial services capital of Canada, and the fastest growing financial centre in North America... the Toronto region boasts North America’s third largest ICT cluster.”

The Nicaraguan capital Managua ranked third for FDI strategy among major cities. In its submission, investment agency PRONicaragua revealed the strategies that are currently being implemented to convince potential investors that Nicaragua – and Managua in particular – is a destination worth considering. One such strategy is the creation of a special public-private commission that will work closely with the World Bank to develop initiatives and policies to improve the country’s business climate and foster the inflow of investment. The top 10 major cities with the best FDI strategies also featured Chicago and Phoenix in the US, Guadalajara in Mexico, Buenos Aires in Argentina, Rio de Janeiro in Brazil, and Barranquilla and Cali in Colombia.

Of the large cities, Ottawa in Canada ranked top of the FDI Strategy category. Invest Ottawa stated that the city is “innovating, collaborating and moving at the speed of industry to achieve sustainable economic growth”. According to its submission, Ottawa is already reaping the rewards of initiatives launched in 2012, with many multinational expanding their presence in the city. Edmonton was placed second, and summarised its appeal as “Canada’s economic and entrepreneurial powerhouse”.

Even though Las Vegas in the US was one of the areas hardest hit by the economic downturn, the city was ranked third for FDI Strategy among large cities. In its submission, Las Vegas pointed to signs of recovery, with the city centre “experiencing a renaissance and an abundance of business activity”. It also stated: “More than $754m in projects came to fruition in 2012 alone.” Rounding off the top 10 were Canada’s Calgary, along with San José in Costa Rica, San Salvador in El Salvador, and the US cities Pittsburgh, Kansas City, Jacksonville and Austin.

Hamilton, Canada, was awarded the Best Mid-Sized American City for FDI Strategy 2013/14 title. One of Hamilton's key goals is the diversification of its industrial base in favour of high-growth sectors, including food and beverage manufacturing, clean technology, health sciences and creative industries. Positioned second, Québec International claims that “diversifying its economy and developing various sectors of excellence have ensured Quebec City an enviable position on the world stage”. Of the top 10 small cities, only Pereira in Colombia and Obregón in Mexico featured from the Latin American region.

Using its marketing slogan “Innovation with an accent”, Lafayette in Louisiana was awarded the prize for top small city with the best FDI Strategy, with Windsor and Richmond Hill – both in Canada – taking second and third place, respectively. Among the micro cities, Canada’s Kamloops ranked top. In a more competitive climate, Venture Kamloops is gearing up for future opportunities to attract FDI – “by mapping out high-speed fibre networks, airport development and fostering of international linkages”. Wooster, Ohio and Greenville, South Carolina complete the top three best micro cities in this year’s FDI Strategy category.

In a weakened global economy, US, Brazilian and Canadian cities continue to attract the lion’s share of FDI into the Americas region. However, cities in Mexico, Colombia and Chile are offering a more competitive deal than ever to entice potential investors, and many governments and investment agencies are implementing initiatives to improve infrastructure, business regulations and financial incentives. With global FDI figures declining, investment promotion agencies will need to understand the changing FDI landscape and offer investors information on advantages unique to their location in order to stand out from the crowd.

Methodology

To create the shortlist for fDi’s American Cities of the Future 2013/14, fDi’s research team collected data using the specialist online FDI tools fDi Benchmark and fDi Markets, as well as other sources.

Data was collected for 422 cities under five categories: Economic Potential, Human Resources, Cost Effectiveness, Infrastructure and Business Friendliness. A sixth category was added: FDI Strategy. In this category, 127 cities submitted details about their current strategy for FDI promotion and this was scored by fDi’s judging panel. Cities scored up to a maximum of 10 points under each datapoint, which was weighted by importance to the FDI decision-making process in order to compile both the subcategory rankings as well as the overall American Cities of the Future 2013/14 ranking.

Population categories

For the 2013/14 ranking, fDi introduced new population category parameters. To categorise cities, fDi took into account both the population of the immediate city area and that of the metropolitan area.

Major (49 cities)

The cities in this category had an immediate city population of more than 750,000 people plus a metropolitan area of more than 2 million, or a metropolitan area of more than 4 million.

Large (52 cities)

This category included those cities with an immediate city population of more than 500,000 plus a metropolitan area of more than 1 million, or a metropolitan area of more than 2 million people.

Mid-sized (80 cities)

The cities in this category had an immediate city population of more than 200,000 people plus a metropolitan area population of more than 750,000, or an immediate city population of more than 350,000 people.

Small (196 cities)

Cities categorised as small had an immediate city population of between 100,000 and 350,000.

Micro (43 cities)

Micro cities had an immediate city population of fewer than 100,000.