One of the economic powerhouses of the African continent, South Africa has been named fDi Magazine’s African Country of the Future 2013/14. A worthy winner, South Africa has consistently outperformed its African neighbours in FDI attraction since fDi Markets records began in 2003. Figures for 2012 build upon South Africa’s historical prominence as an FDI destination with the country attracting about one-fifth of all investments into the continent – more than double its closest African rival, Morocco. In 2012, FDI into South Africa amounted to $4.6bn-worth of capital investment and the creation of almost 14,000 jobs.

In the five years or so since the financial crisis made its impact felt, global FDI remains 20% lower than figures recorded in 2008. Any hints of global recovery in FDI in 2010 and 2011 have been overshadowed by the 14.3% decline in 2012. In the context of this decline, the number of investments into the African continent fell to a lesser extent than any other world regions, down 7.9% in 2012. However figures for the first five months of 2013 signal that FDI into Africa is falling at about the same rate as global averages, down 27% compared to 28% globally.

Advertisement

Unrest, corruption and severe income disparities persist in Africa, though an emerging middle class with increased disposable income, a marked improvement in governance and the availability of natural resources present an attractive opportunity for investors. According to a recent report by the African Development Bank, Africa’s economy is growing faster than any other continent. Of the 54 African countries, 26 have now achieved middle-income status, with some countries, such as South Africa, Morocco and Mauritius, significantly outperforming the likes of Somalia and the Democratic Republic of Congo.

South Africa's resilience

South Africa claimed the title of fDi’s African Country of the Future 2013/14 by performing well across most categories, obtaining a top three position for Economic Potential, Infrastructure and Business Friendliness. Its attractiveness to investors is evident in its recent FDI performance, where the country defied the global trend with 2011 and 2012 figures surpassing its pre-crisis 2008 statistics. Despite a slight decline of 3.9% in 2012, South Africa increased its market share of global FDI, which further increased in the first five months of 2013 as the country attracted 1.37% of global greenfield investment projects. According to fDi Markets, South Africa now ranks as the 16th top FDI destination country in the world.

South Africa’s largest city, Johannesburg, was the top destination for FDI into Africa and is one of only five African cities that attracted more investments in the first five months of 2013 compared to the same period of 2012. South Africa ranked third behind the US and the UK as a top source market for the African continent in 2012, accounting for 9.2% of FDI projects.

In 2010, South Africa became the ‘S’ of the BRICS – five major emerging national economies made up by Brazil, Russia, India and China. While FDI into South Africa fell 3.9% in 2012, this was the lowest recorded decline of the BRICS grouping which, on average, experienced a 20.7% decline in FDI. In its submission for fDi’s African Countries of the Future 2013/14, Trade and Investment South Africa (TISA) stresses the importance of the country's attachments to its BRICS partners. “South Africa’s participation in the BRICS grouping is significant… as it provides important opportunities to build South Africa’s domestic manufacturing base, enhance value-added exports, promote technology sharing, support small business development and expand trade and investment opportunities,” says TISA.

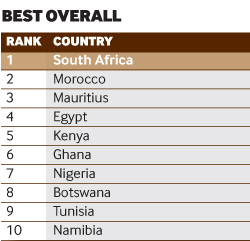

Familiar look at the top

Advertisement

South Africa, Morocco and Mauritius have maintained their top three positions in the ranking, though Morocco has been ousted from the top spot in part due to its 17% FDI decline in 2012. Home to the Tangier Free Zone (ranked sixth in fDi’s Global Free Zones of the Future 2012/13), Morocco still provides a healthy FDI story, attracting 8.3% of all investments into Africa last year. The country ranked second in the Infrastructure category and joint top for FDI Strategy.

Egypt ranks fourth in fDi’s African Countries of the Future 2013/14 table. However, as these results went to press, turmoil erupted in the country following the ousting of its president, Mohammed Morsi. As fDi Magazine’s African Countries of the Future ranking is primarily based on the analysis of FDI data, it is important to note that prior to the current political situation, the country had witnessed a 20% increase in inward investment in 2012.

Kenya has climbed the overall rankings, moving from 10th in the 2011/12 ranking to fifth position this year. Since 2008, FDI into the country more than doubled and the latest figures from fDi Markets show that Kenya has already attracted 9.43% of inward investment into Africa in the first five months of 2013. Currently, Kenya ranks second behind South Africa as the top FDI destination in 2013. Kenya continues to diversify its economy and the widely adopted use of M-Pesa mobile payment has opened the door to many new investment opportunities. Nigeria and Botswana are the new entrants in the top 10, ranking in seventh and eighth place, respectively.

Places of potential

South Africa is top of the Economic Potential table. The country's GDP stands at more than $5.8bn and it is the largest economy in Africa. South Africa has attracted more R&D investments than other African country and accounts for the largest number of patents registered in the continent. Exports from the country increased 24% in 2011 whereas imports increased 18% when compared to 2010 figures, and both were more than 13% higher than 2008 levels.

Nigeria comes in second behind South Africa in the Economic Potential category. Despite major issues such as corruption, security and infrastructure inadequacies blighting the country in recent years, Nigeria has seen its GDP almost treble since the turn of the century. According to the Nigerian Investment Promotion Commission’s submission for fDi’s African Countries of the Future, the Nigerian government is keenly aware that major issues need to be tackled in order for the country to unlock its potential. To address this, it says the government has “implemented various improvement measures in order to reach its goal of being one of the world's 20 largest economies by 2020.”

Following a slight decline in FDI in 2009/10, investments into Nigeria increased 41% in 2011 and a further 20% in 2012. The oil industry is a dominant feature of the Nigerian economy, though the communications sector is also a strong area of growth. According to fDi Markets, FDI in the communications sector accounted for one-quarter of all investments in the country in 2012, and as penetration levels remain relatively low in this large and growing consumer market, this sector continues to offer huge opportunities to existing and new players alike.

A new entrant into the top 10 for Economic Potential, Kenya ranked third thanks largely to its strong performance in FDI attraction. Kenya’s capital, Nairobi, was the fastest growing African city for FDI between 2009 and 2012 and was second only to Johannesburg as a destination for FDI in 2012. Many initiatives are currently being developed to drive the Kenyan economy and in turn encourage investors into the country. In its submission for fDi’s African Countries of the Future, KenInvest says: “The development of the national investment policy… is aimed at streamlining the investment promotion and facilitation process in Kenya to make it simpler. Full implementation of the… new constitution is on its own expected to increase the level of foreign participation in the country”.

A well-administered country by regional standards, Ghana ranks fourth in the Economic Potential category of fDi’s African Countries of the Future 2013/14. In the past few years, Ghana has attracted its largest ever FDI project following the discovery of major offshore oil reserves in 2007. In July 2009, South African company New Alpha Refinery announced plans to construct a new $6bn oil refinery in Accra in what will be the largest refinery in west Africa. With production set to begin in 2015, the refinery should initially produce 200,000 barrels of oil per day with a view to eventually doubling capacity.

Labour and costs

Mauritius tops the table in Africa when it comes to the Labour Environment category. With a reputation for political and social stability, Mauritius is recognised as a middle-income country with a greater degree of equality compared with other African nations. High-end FDI has been a boon to Mauritius, with more than half of all inward investment involved in the business and financial services sectors. On its own, Mauritius's financial services sector accounts for 13% of the country's GDP and directly employs more than 15,000 highly skilled professionals.

Tunisia ranks second in the Labour Environment category. Currently undergoing great social and political change, Tunisia has one of the top tertiary education enrolment rates in Africa, combined with a comparatively high life expectancy. Being home to eight of Africa’s top 200 universities has helped Egypt place in third, while Algeria and Libya complete the top five.

Madagascar is the leading African country in the Cost Effectiveness category. Low wages combined with low property costs have helped Madagascar attract investors involved in manufacturing and extraction, with these activities accounting for 40% of investments on the island. One of the world's poorest countries, Mauritania is in second place in this ranking. Although rich in natural reserves, the country has been unable to capitalise on its discovery of oil in 2001.

Infrastructure issues

Despite the continent experiencing some economic growth, Africa's infrastructure remains a major constraint that hinders its ability to unlock its vast human and economic potential. Africa only invests 4% of its collective GDP in its infrastructure.

Egypt offers one of the more advanced infrastructure set-ups in Africa, and as such is awarded the top spot in our Infrastructure category. Prior to the unrest that the country is currently experiencing, Egypt had a thriving tourist industry which accounted for more than 10% of its economic output. Airports in Egypt offer connections to more than 100 international destinations, and the country is also home to a number of significant ports due to its strategic location between Europe, Africa and the Middle East. Egypt also has one of the highest rates of internet usage in Africa.

Morocco is another African country with a relatively well developed infrastructure system. Moroccan airports are connected to more than 80 international destinations and its largest city, Casablanca, is home to the second largest port in Africa. Future infrastructure projects for Morocco include a $35bn investment in its rail networks as well as the development of the world’s largest solar power plant, which commenced construction in May 2013.

South Africa is in third place in the Infrastructure category. The South African government has set out plans to invest $92bn in its infrastructure over the next three years. The biggest chunk of the investment will come from the South African electricity utility company Eskom, and incorporates plans for two new power stations, Medupi and Kusile, which are expected to start producing electricity in 2014 and 2015, respectively.

Business friendly?

When it comes to business-friendliness, South Africa is fDi's top African country. A testament to its open and stable business environment, the country boasts the highest cluster of knowledge-based companies. South Africa also recorded the highest number of expansions in the region on the real-time FDI database, fDi Markets, a clear indication that business are happy to do business in the country.

Egypt ranks second for business-friendliness, with fDi Markets recording nine FDI signals (early-warning signs that a company may be considering investment) in the past 18 months. Given the country's current political unrest, it remains to be seen how many of these projects will come to fruition.

With one of the lowest corporation tax rates in the region, Mauritius is third for business-friendliness. According to the latest World Bank Doing Business ranking, Mauritius is the easiest location in Africa for doing business, and is positioned 19th globally.

Comparative strategies

Based on information submitted by African countries with regards to their FDI strategies, Mauritius and Morocco finish joint top of our FDI Strategy category.

Promoting itself as "the jewel of Africa", Mauritius is targeting investors in the financial services, hospitality, property development, IT and business process outsourcing sectors. In its submission, the Mauritian Board of Investment (BOI) looks to the future of the African region, saying: “Since the global investment trend is gradually shifting towards Africa, BOI is positioning itself to play a crucial role in positioning Mauritius as the gateway to this new frontier of growth.”

Morocco’s FDI-friendly environment is encapsulated in Agence Marocaine de Developpement des Investissements' African Countries of the Future submission, which says: “With its solid macroeconomic fundamentals, unique set of free-trade agreements, competitive labour costs, world-class infrastructure, business-friendly environment and attractive set of incentives, Morocco has all the ingredients to become a location of the future.”

One of the world’s largest producers of diamonds, Botswana enjoys stable economic growth, low levels of corruption and a stable political regime, one of the few such success stories in Africa. Botswana Investment and Trade Centre has recently launched a brand awareness scheme with the slogan ‘Go Botswana’ which it states “highlights our national assets, including our people, culture, tourism attractions, business potential and our reputation as a country with good governance.”

Namibia, which is placed in fourth in the FDI Strategy category, highlighted in its submission its efforts to realign its strategy in order to attract future FDI. Its entry states: “To kick-start the process of addressing Namibia’s economic and business ratings, consultations with World Bank experts are already under way. We have established the Business and Intellectual Property Authority (BIPA) to improve service delivery and the effective administration of business and intellectual property rights registration by serving as a one-stop centre. The review of our incentives also cements the country’s commitment to increasing greenfield and brownfield FDI.”

Africa has experienced significant growth in the past decade. However this growth should be viewed in context – the countries on the continent are expanding from a low base and living standards as well as business environments often do not measure up to other world regions. Yet this represents an opportunity for future growth. If the region continues in its efforts to tackle poverty, corruption, inadequate infrastructures and political issues, Africa’s competitiveness on a global scale can only get better.

Methodology

To create the shortlist for fDi African Countries of the Future 2013/14, the fDi Intelligence division of the Financial Times collected data using the specialist online FDI tools fDi Benchmark and fDi Markets as well as other sources. Data was collected for 55 countries under five categories: Economic Potential, Labour Environment, Cost-Effectiveness, Infrastructure and Business Friendliness. A sixth category was added: FDI Strategy. In this category, 20 submissions were received from African countries regarding their current strategy for FDI promotion and this was scored by the judging panel. Countries scored up to a maximum of 10 points under each individual data point, which were weighted by importance to the FDI decision-making process in order to compile both the subcategory rankings, as well as the overall African Countries of the Future ranking.

Click on the link below for a PDF version of the complete results: