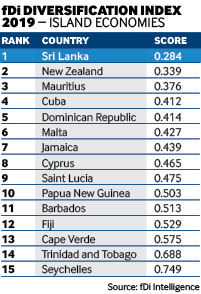

Sri Lanka has once again been named fDi’s most diversified economy, with a score of 0.284. Between 2014 and 2018, the Indian Ocean island received 156 FDI projects across 26 sectors, according to greenfield investment monitor fDi Markets. More than 17% of these projects were in the financial services sector, followed by food and tobacco (almost 10%) and business services (more than 8%).

Further reading:

Advertisement

fDi’s Island Economies of the Future 2019/20 – the results

Download a PDF of these rankings here:

In 2016, the UK-based London Stock Exchange established a service centre in Colombo, which resulted in the creation of 400 jobs, the largest project by job creation in Sri Lanka’s financial services sector in the time analysed. Recent investments in the sector have come from Bank of China, Doha Bank and US-based Visa International.

New Zealand's job boost

New Zealand is in second place in this year’s index with a score of 0.339. While total FDI projects between 2017 and 2018 decreased in the country, it is worth noting the average number of jobs and capital investment per project. Average capital investment peaked in 2018 at $53m, from a base of $28.5m in 2014 and a low of $18m in 2016. The average number of jobs created per project reached its lowest in 2016, when 48 jobs were created per project on average. By 2018, this figure had climbed to 75, just below the 2014 peak of 79.

One of the largest investments into New Zealand in 2018 came from Synlait Milk, a subsidiary of China-based Bright Food, which established a nutritional powder manufacturing facility in North Waikato at a cost of $189m.

Advertisement

Mauritius rises from 11th place in 2018 to third position this year, with a score of 0.376. In the time period analysed, the largest investments into Mauritius were in the business services sector (US-based Convergys established a contact centre in capital Port Louis in 2016, creating 600 jobs) and in warehousing, when South Africa-based XtraSpace established two storage units in the country with an estimated investment of $220m.

Methodology

To generate the list of island economies to be assessed, fDi first set some parameters:

- a population of fewer than 25 million people;

- a GDP per capita purchasing power parity of less than $50,000;

- a minimum of 20 greenfield FDI projects recorded between 2003 and 2017.

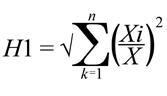

The index is created based on the Hirschman Index (the most widely used measure of trade and commodity concentration) using the following formula:

- the formula is adapted to focus on FDI rather than exports;

- where Xi is the FDI value of sector i and X is the country’s total FDI;

- the formula is run for both projects and capital investment and an average of the two scores is used to create the fDi Diversification Index score;

- the lower the score (HI), the more diversified an economy is; the higher the score the more specialised the economy is.