Organisations have been outsourcing IT for many years. With the advent of remote access, reduced telecoms costs and significant IT-savvy resource pools at reduced rates, IT was one of the first business areas in the outsourcing market. The results of Trestle Group Research’s annual outsourcing survey confirm this. The survey was conducted among upper-level management, primarily from the financial services, telecoms and manufacturing sectors, based in 16 countries, 70% of which are in the EU.

Of respondents who cited current outsourcing initiatives in place in their firms, 74% stated that their firms were outsourcing at least one of their IT functions. Categories of IT functions included network operations, application development, security, website development/management, architecture, data centre operations, application management and customer support.

Advertisement

IT outsourcing continues to dominate; however, in the global marketplace, an increasing number of companies, both multinationals and service providers, are heading into the business process outsourcing (BPO) arena. Many business processes are being outsourced, such as transaction processing, accounting, corporate identity design, promotional material, human resources, help-desk support, call centres, multimedia and customer support.

According to the survey, 59% of respondents claimed that their institutions were outsourcing at least one business process and the majority were outsourcing more than one.

Sea of choices

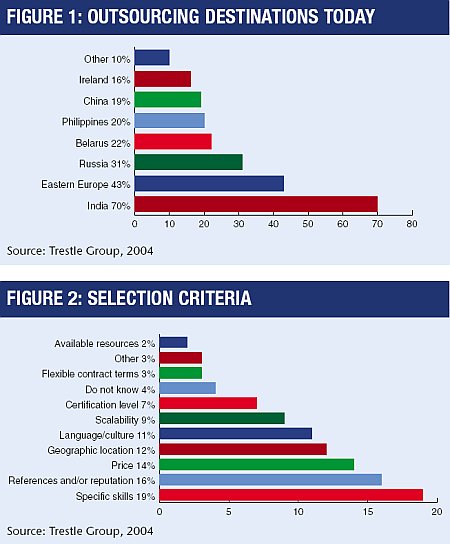

Even though India is established as the undisputed leader in the global outsourcing market, many companies are choosing near-shore destinations for reasons of proximity and cultural closeness. Based on those reasons as well as the high percentage of respondents in EU member countries, the survey shows an increase in outsourcing activity in eastern Europe (see figure 1).

Advertisement

One factor that may contribute to this trend is proximity: travel to near-shore locations is both faster and often more convenient for senior managers whose schedules are already strained by frequent travel.

As demand for outsourcing increases, there is a corresponding increase in the supply of outsourcing service providers. This is healthy for competition and raises quality, but the downside is that firms are forced to evaluate more service providers in more geographical locations.

Whereas a few years ago, only a small number of service providers existed for each outsourcing project, there is now a sea of highly skilled and qualified service providers available in any given market – a positive problem that firms face when selecting an outsourcing service provider. This is verified in the survey results: 39% of respondent firms considered four to six service providers and 18% considered seven to 10.

Growth continues

The outsourcing service provider market has begun to consolidate in select markets like India, but globally the market is still growing and will continue to do so, at least in the short to medium term.

With the abundance of service providers available, firms must prioritise selection criteria and justify their choices of service providers to top management. The broad distribution of important selection factors chosen by the survey respondents illustrates the goals, objectives and risk appetites that are unique to each firm.

According to the survey results, specific skills and reputation are considered more important than price (see figure 2). Corporations are aware that, although they must benefit from reduced cost to justify their investment in offshoring, benefits from skill sets and experiences gained provide the ultimate advantage. Respondents emphasised the need for a thorough due diligence process and confirmation of the competencies of service providers.

Healthy relationships

The survey examined respondents’ opinions on success factors, benefits and challenges in outsourcing initiatives, among other factors. Overall, participants agreed that the key to a successful outsourcing initiative is to learn from outsourcing pioneers, adapting best practices developed during their experiences to future outsourcing initiatives.

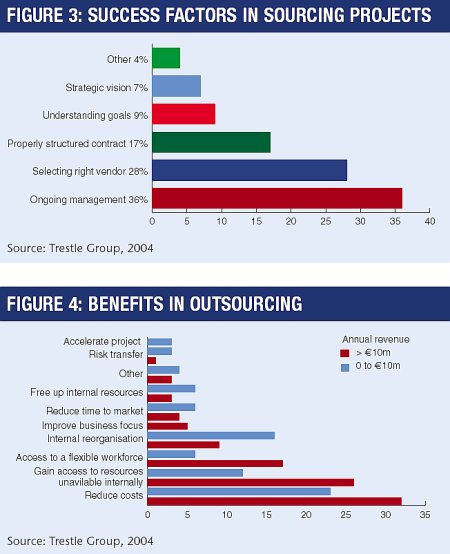

Figure 3 depicts only those responses from respondents with previous experience in outsourcing projects. Although there were slight variances by industry, respondents overwhelmingly agreed that ongoing management and selecting the right vendor were the most important success factors.

A properly structured contract ranked third, confirming Trestle Group’s belief that a contract is extremely important but is only a collection of words on paper. It is the relationship with the vendor that acts as the glue that holds the whole deal together, ultimately ensuring delivery.

Benefits and motives

The top outsourcing benefit according to all respondents, regardless of the size of the organisation, was reduced costs (see figure 4). However, smaller firms (with annual revenue up to E10m) cited second and third place benefits that differed from those of larger firms (with annual revenue of more than E10m). Their second choice was gaining access to resources unavailable internally; and their third choice was access to a flexible workforce. Larger firms chose improving business focus followed by facilitating internal reorganisation.

Smaller firms’ main motive for outsourcing is often the need for resources rather than a realignment of strategic focus. Larger firms, in comparison, have historically been self-contained organisations. They are now, however, realigning their strategic focus by taking closer looks at departmental efficiencies and outsourcing non-core or underperforming processes. Better business process management tools have enabled top-level executives to keep their fingers on the pulse of individual departments, effectively uncovering those that are not up to par.

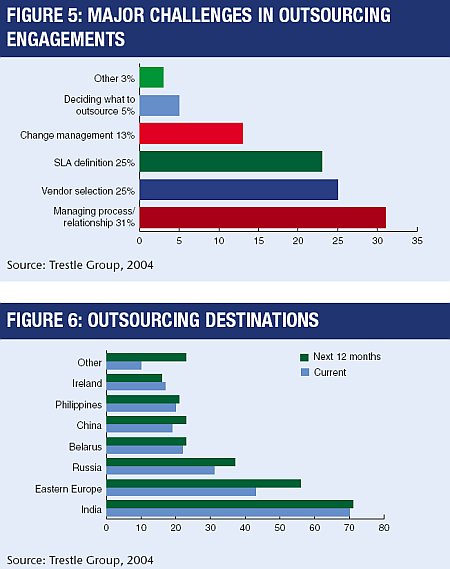

Large and small firms agree that outsourcing brings many benefits, including reduced costs, improved business focus and access to resources that are not available internally. But with these benefits come challenges. Almost the same benefits (maintaining ongoing management, selecting the right vendor and properly structuring contracts) that the respondents identified as success factors mirror those identified as challenges: managing processes/relationships, selecting a vendor and defining service level agreements (see figure 5). To meet the challenges in outsourcing engagements, respondents invest in vendor relations and ongoing management to ensure that the benefits of outsourcing are realised.

More to come

Compared with the 69% of respondents that said their companies outsource either IT or BPO, 79% stated that their firms would continue to do so for the next 12 months. Continued focus on reducing costs is one of the key drivers for the increase in future outsourcing initiatives.

According to the professionals responding to the survey, IT outsourcing will continue to grow to a staggering 79% as companies seek to reduce costs and focus on their core competencies. This does not mean that they are going to outsource their entire IT departments. Only non-strategic pieces of the IT organisation will be outsourced, leaving the remaining department to focus on core competencies.

The most notable increase in outsourcing activity is in the BPO sector. As companies become more comfortable with outsourcing pieces of their IT departments, they are realising that outsourcing is also beneficial in other aspects of their non-core businesses. They are asking: “Why do we still perform this business process when another company can provide it cheaper and better?”

The survey shows that BPO will increase 11% in the next 12 months as firms continue to reap the benefits of BPO and build on successful outsourcing initiatives.

Destinations

When respondents were asked to list their firm’s current outsourcing destinations, 17 locations were named. As countries such as Jordan, Armenia and South Africa find that their economies can benefit from being preferred outsourcing destinations, companies are beginning to take notice, taking into account proximity, government support and reduced labour costs.

India remains the number one outsourcing destination (see figure 6) and is expected to remain the leader in the next 12 months. However, companies are exploring other locations: 56% of respondents listed eastern European outsourcing providers as the likely recipients of projects in the next 12 months, 13% higher than current initiatives.

Of all outsourcing destinations listed, Ireland was the only country predicted to lose outsourcing business in the coming year. One possible explanation is the rising cost of labour as a result of Irish workers’ demands for higher wages. Indian service providers are also battling higher labour costs and facing increased competition from countries such as China.

Organisations across sectors regard the most important factor in outsourcing success as maintaining ongoing management with the service provider but they also see this as the greatest challenge. Companies that are successful in managing their relationships with vendors will be able to reap the greatest benefits from outsourcing initiatives.

Based on the results of those surveyed, both IT and BPO will increase substantially in the next 12 months (5% and 11% respectively). Companies will explore more BPO opportunities as they become comfortable with current outsourcing initiatives and are forced to narrow their focus to core business in the face of unrelenting cost pressures and competition. An increasing number of service provider destination countries are being considered by companies seeking to find the lowest-cost and highest-quality providers available. Near-shore locations proved popular with survey respondents, as companies seek to outsource their IT functions or business processes to service providers within arms’ reach in order to manage ongoing vendor relationships.