Economic vulnerabilities in emerging markets dominated the discussion at this year’s World Bank/IMF annual meetings in Bali, Indonesia, with rising debt levels in many emerging markets one key cause for concern.

“Emerging market public debt is at levels last seen during the 1980s debt crisis. And if recent trends continue, many low-income countries will face unsustainable debt burdens,” IMF managing director Christine Lagarde has stated.

Advertisement

The problem is especially serious in Africa. In two years, average external government debt payments have doubled from 5.9% of government revenue in 2015 to 11.8% in 2017 – the highest level since 2001. According to the World Bank and IMF, 16 countries in Africa are either in debt distress or at high risk of becoming so.

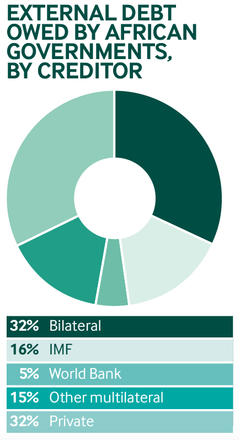

China has found itself in the crosshairs, with many accusing the world’s second largest economy of engaging in predatory lending to countries across Asia and Africa, often for Belt and Road-linked infrastructure projects. However, new analysis from the Jubilee Debt Campaign – which helped orchestrate debt forgiveness for highly indebted developing countries at the beginning of the millennium – shows that China only accounts for about 20% of African governments’ external debt.

“Debt problems are worsening on the African continent, but many lenders bear responsibility, not just China,” said Tim Jones, economist at the Jubilee Debt Campaig. “We need new rules to make all lenders publicly disclose loans to governments at the time they are given.” The lion’s share – 35% – is, in fact, owed to multilateral institutions. Of this, 16% is owed to the World Bank and five per cent to the IMF.

Thirty-two per cent of total debt is owed to the private sector. The higher interest rates on commercial loans means 55% of all interest payments are owed to private entities, compared with 17% to China.

The make-up of debt burdens vary considerably from country to country, however. Those at high risk of debt distress who owe China the most are Djibouti (68%), Zambia (30%) and Cameroon (29%). Of the other countries on the high-risk list, their governments owe less than 18% to China.

The accumulation of debt by many governments in the African region is the product of factors including ambitious development and infrastructure projects, the commodities shock of 2015 and the rising value of dollar interest as the US Federal Reserve tightens conditions. Fiscal mismanagement and bad luck also play a role.