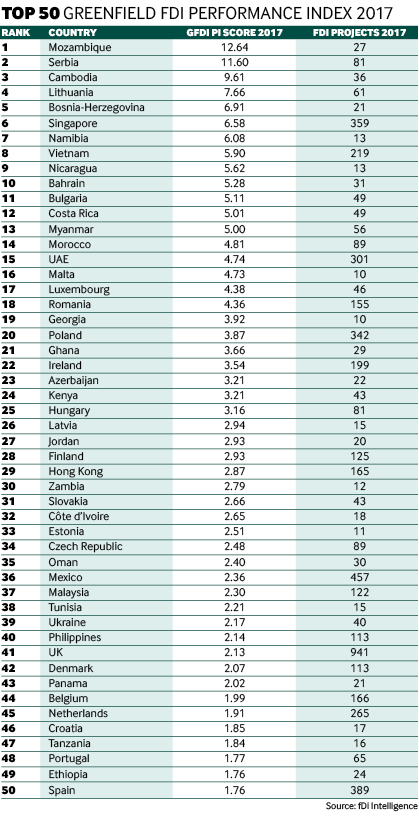

Mozambique tops the 2017 Greenfield FDI Performance Index. The southern African country is ranked number one in the annual study by fDi Intelligence, a Financial Times data division of which fDi Magazine is also a part, which looked at inbound greenfield investment in 2017 relative to the size of each country’s economy. Mozambique scored 12.64 in the index, closely followed by Serbia (11.6) in second and Cambodia (9.61) in third.

Mozambique has doubled its index score from 2016. Greenfield foreign investors announced 27 projects in the country in 2017, up from 12 in 2016. Although Mozambique exhibited strong economic growth – predicted to total $12.68bn in 2017 – it has been outpaced by inbound FDI project growth.

Advertisement

Almost one in five projects were in the financial services sector, while fossil fuels and real estate were the country’s most important sectors for greenfield FDI.

Serbia, the top location for 2016, drops to second place. The south-east European country marginally increased both its number of FDI projects (from 77 in 2016 to 81 in 2017) and index score (11.4 in 2016 to 11.6 in 2017).

Above expectations

Of the 92 locations analysed in the 2017 Greenfield FDI Performance Index, 67 had an index score greater than 1, while 25 had a score less than 1. A score of 1 indicates a country’s share of global inward greenfield FDI matches its relative share of global GDP. A score greater than 1 indicates a larger share than indicated by its GDP and a score of less than 1 indicates a smaller share.

Mozambique, with a score of 12.64, is attracting more than 12 times the amount of greenfield FDI that might be expected given the size of its economy.

The index uses a methodology devised by Unctad for overall FDI, and applies it to only greenfield FDI – excluding M&A, intracompany loans and other forms of crossborder investment.

Advertisement

Of the 10 largest economies in the world, only the UK (2.13), India (1.46), France (1.6) and Germany (1.34) had index scores above 1. Six of the top 10 had a lower 2017 score compared to their 2016 score (including Germany, India and the UK).

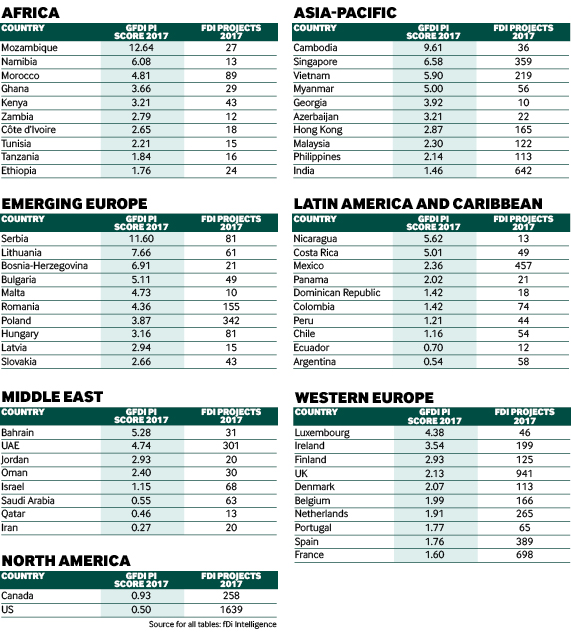

Regional analysis

Africa

Fourteen African countries make it into the index, of which only Nigeria and Algeria had a score of less than 1. Aside from Mozambique, which tops the overall index, Namibia had the next largest index score (6.08). The southern African country is a new addition, having surpassed the 10-project threshold for inclusion by receiving 13 FDI projects in 2017, worth an estimated $108m.

Asia-Pacific

Accounting for almost one-quarter of all countries listed in the index, Asia-Pacific has 14 countries with a score greater than 1 (and eight with a score less than 1). Cambodia is the leading Asian country, and ranks third overall, with a score of 9.61. Singapore (6.58) and Vietnam (5.9) rank second and third, respectively. These latter two countries are the highest scoring globally of any country that received more than 100 inbound projects in 2017.

Emerging Europe

Seventeen of the 18 emerging European countries analysed recorded a score of greater than 1. Only Russia, which scored 0.79, fell below the proportional benchmark. Serbia has far exceeded its regional counterparts, such as Lithuania, Bosnia-Herzegovina and Bulgaria, who themselves have high index scores.

Latin America and Caribbean

Nicaragua – another new entrant into this year’s index – pips Costa Rica to lead the Latin America and Caribbean regional index. The two central American countries scored 5.62 and 5.01, respectively, and significantly outscored their nearest competitors, Mexico (2.36) and Panama (2.02). Brazil ranks bottom of the 11 countries analysed from the region – its score of 0.52 was 0.05 points lower than in 2016.

Middle East

Five of the eight Middle Eastern countries analysed had scores above 1. Bahrain tops the regional index with a score of 5.28, followed by the United Arab Emirates with 4.74. The number of greenfield FDI projects into these eight countries increased by 3.8% in 2017, while across the Middle East region as a whole projects rose by 2.3%. The UAE has the third largest score of any country globally in receipt of more than 100 inbound projects.

North America

Canada and the US both scored below 1, indicating they are larger global players in respect of GDP relative to FDI. Both had relatively stable scores compared to last year’s index; Canada scored 0.93 in 2017 compared to 0.94 in 2016, while the US increased marginally by 0.02 index points to 0.5 in this year’s index. Both the US (4.1%) and Canada (1.6%) had increases in the number of inbound greenfield FDI projects in 2017.

Western Europe

Luxembourg tops the western European regional index. The country received a record number of greenfield FDI projects in 2017, which positively impacted its index score, beating Ireland, which was regional leader in 2016. Just under 40% of all greenfield FDI projects into Luxembourg in 2017 were in the financial service sector.

Finland (2.93), the UK (2.13) and Denmark (2.07) are the next highest scorers in western Europe. Inward greenfield FDI projects into the UK declined by 10% in 2017, possibly linked to the UK’s impending exit from the EU, with investors deciding to establish operations in competitor locations. Its index score declined by 0.09 points from 2016.

Greenfield FDI data used in the index is derived from fDi Markets, and excludes retail investments. The 2017 index had 92 countries, two fewer than the 2016 index. There were four new entrants: Namibia, Nicaragua, Georgia and Belarus. To be included in the index, a country must have received at least 10 greenfield FDI projects in 2017. The 2016 FDI figures were revised from last year’s index as further project information became available in 2017/18. GDP figures were also revised on more recent data from the IMF (from the second quarter of 2018).