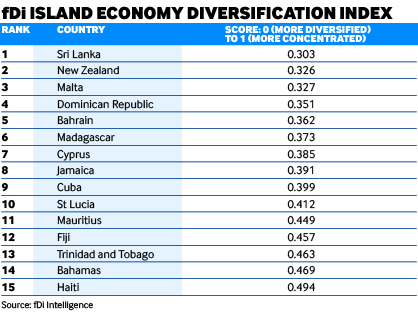

With a score of 0.303, Sri Lanka has been named as fDi’s most diversified island economy for the third year running. The country received investment in 33 sectors in the 15 years to 2017. The communications sector has rebounded somewhat in Sri Lanka, with job creation and investment in the sector peaking in 2017 after experiencing declining investment between 2013 and 2015.

In July 2017, Dialog Axiata, a subsidiary of Malaysia-based Dialog Group, established a new data centre and media hub in the country’s capital, Colombo. Two months previously, US-based CloudFlare opened a data centre in the city to provide security and optimisation services for the domestic market.

Advertisement

New Zealand has also held on to second position. The country of more than 4.5 million people scored 0.326 in the index. Software and IT services and business services are the main sectors attracting investment. Almost one-third of the projects recorded between 2003 and 2017 were in sales, marketing and support operations, 27% in business services and 12.4% in manufacturing.

The highest level of capital investment in New Zealand was in the coal, oil and gas sector, which witnessed investments totalling almost $2bn. However, there has been no investment in the sector since 2012. In 2006, $898m was invested – the peak year throughout the 15-year period. The communications sector has seen increasing levels of capital investment, attracting $1.17bn between 2013 and 2017, compared with just $215m in the previous five-year period between 2008 and 2012.

Third placed in the index is Malta, which has displaced Dominican Republic. Malta ranks just behind New Zealand with a score of 0.327. Its financial sector attracted more than one-fifth of all FDI between 2003 and 2017, including investments from UK-based banking giant HSBC, Netherlands-based Citco Group and Hong Kong-based crypto-currency exchange platform company Binance.

Methodology

To generate the list of island economies to be assessed, fDi first set some parameters:

Advertisement

- a population of less than 25 million people;

- a GDP per capita purchasing power parity of less than $50,000;

- a minimum of 20 greenfield FDI projects recorded between 2003 and 2017.

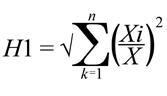

The index is created based on the Hirschman Index (the most widely used measure of trade and commodity concentration) using the following formula:

- the formula is adapted to focus on FDI rather than exports;

- where Xi is the FDI value of sector i and X is the country’s total FDI;

- the formula is run for both projects and capital investment and an average of the two scores is used to create the fDi Diversification Index score;

- the lower the score (HI), the more diversified an economy is; the higher the score the more specialised the economy is.