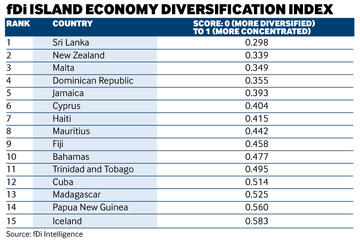

Sri Lanka has been ranked as the most diversified island economy in the first fDi Diversification Index. The south Asian country scored 0.298, followed by New Zealand (0.339), Malta (0.349), the Dominican Republic (0.355) and Jamaica (0.393).

Sri Lanka received 308 greenfield FDI projects between 2003 and 2015, spread across 34 different sectors. The country’s primary FDI sectors in that time were financial services, transportation, business services and software and IT services. Companies that have established operations in Sri Lanka include Allianz Group (financial services), Deutsche Post (transportation logistics) and WPP (advertising). During the period analysed, the country’s unemployment rate fell from 8.4% in 2003 to 4% in 2015. Although economic growth has been revised downward given the country’s recent $1.5bn IMF bailout, Sri Lanka is still expecting annual economic growth of more than 6% in real terms over the next five years.

Advertisement

Making a connection

New Zealand reported a higher number of inward FDI projects (425) than Sri Lanka, but it had less dispersion across sectors, meaning its level of diversification was slightly lower. Malta attracted 114 projects across 22 different sectors, while the Dominican Republic received 173 projects and Jamaica 61 projects across 26 and 16 sectors, respectively.

Of the 16 locations analysed, there was a relatively strong correlation between how diversified an economy is and the number of FDI projects it received. In general, the higher the number of FDI projects received, the more diversified the economy in terms of FDI (a lower index score).

The index analysed 16 island economies across 39 FDI sectors to determine how diversified their levels of greenfield FDI have been since 2003. fDi used the Hirschman Index for export diversification as a base and calculated a score for FDI projects and capital investment using data from greenfield investment monitor fDi Markets.

The scores for each location ranged between zero (fully diversified) and one (fully specialised). The lower the score, the more diversified the economy is in terms of FDI; the higher the score, the more concentrated.

Methodology

Advertisement

The fDi Diversification Index is a weighted average of the fDi Diversification Score for FDI projects and FDI capital investment.

For FDI projects, the result is the square root of the sum of the square of the number of projects in sector x, divided by the total number of projects, for each of the sectors whereby the location receives FDI.

For capital investment, the result is the square root of the sum of the square of the FDI capital investment in sector x divided by the total FDI capital investment, for each of the sectors whereby the location receives FDI.

The index then applies equal weight (50%:50%) to both projects and capital investment figures to give the overall index score.

The list of locations was devised by analysing island economies with a population of less than 25 million, a GDP per capita below $50,000 and a minimum of 20 inward greenfield FDI projects. Sixteen island economies met the criteria (the 15 listed in the final index plus the Maldives).