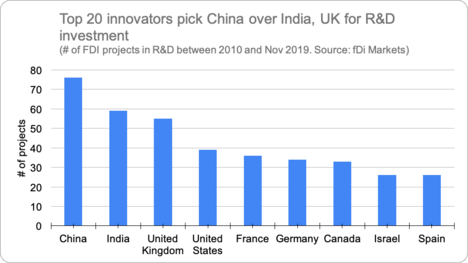

Top global innovators made China their choice of preference for investment into research and development (R&D) activities over the past decade as the country’s economic promise overshadowed concerns over intellectual property rights.

The world’s top 20 biggest investors in R&D – compiled from a list produced from reports by the European Union and consultancy PwC that features Amazon, Alphabet and Volkswagen in the global top three – announced 73 R&D projects in China in the past decade (through November 2019), followed at a distance by India (59) and the UK (55), according to figures from foreign investment monitor fDi Markets.

Advertisement

Tech pioneers

Tech companies such as Microsoft, Apple, Intel and Amazon have been at the forefront of investment into innovation in the country, alongside major automotive groups such as Volkswagen, BMW, Ford and Toyota.

The nature of the R&D operations that multinational companies set up in the country has been evolving hand-in-hand with the rapid development of the Chinese economy.

In the early 2000s, multinational corporations (MNCs) would set up R&D centres in China to take advantage of the low cost of land, labour and capital. Gradually MNCs have widened the functions of these centres to better adjust their products and commercial offerings to the changing characteristics of the Chinese market.

“China’s rapidly growing consumer base often demands different types of products than in the West, and preferences tend to change more quickly as well – all of which increasingly requires China-specific R&D,” the American Chamber of Commerce in Shanghai wrote in 2018 following a survey among 52 foreign investors running R&D operations in China. “Meanwhile, the availability of a higher level of talent and technology has further attracted foreign R&D, while the high costs of land and labour have now become major impediments.”

Advertisement

Holding back

However, the survey also found that “most companies remain hesitant to bring their core technologies” and consider their local R&D activities of minor, if not minimal importance when seen through the prism of their global footprint.

A major reason for this relates to the lack of intellectual property (IP) protection, as the majority of the surveyed investors confirmed.

China’s attitude towards IP rights has stirred controversy for years and recently became one of the main points of friction between Beijing and the US administration led by president Donald Trump. In the so-called Phase 1 trade deal struck by the two governments on January 15, China made major commitments to improve IP protections, particularly in the fields of trade secret protection; strengthening pharmaceutical-related IP; granting patent term adjustments and extensions; preventing piracy and counterfeiting on e-commerce platforms; increasing transparency in geographical indications protection; preventing manufacture and export of counterfeit goods; stopping bad-faith trademarks; and increasing bilateral cooperation on IP protection.