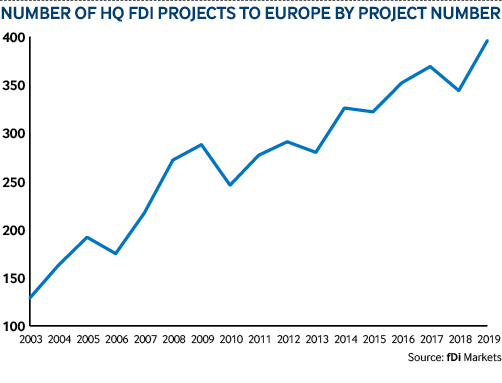

An increasing number companies are establishing headquarters away from their home countries, according to greenfield investment monitor fDi Markets, and this foreign investment trend has grown consistently over the last 17 years.

Companies worldwide established 912 headquarters abroad in 2019, an all-time high that resulted in $16bn of spending, fDi Markets figures show. Roughly 40% of those projects went to Europe, making it the world’s leading region for FDI in headquarters, followed by North America and Asia-Pacific.

Advertisement

An unprecedented number of foreign companies set up headquarters in Europe in 2019, following almost two decades of near-consistent growth in this regard (see table 1).

Dublin's big draw

Dublin is the leading destination city for foreign investment in headquarters, according to fDi’s Top Headquarter Locations in Europe, a ranking that weighs fDi Markets data (since 2015) against locations’ population size.

With its culture, heritage and spectacular surrounding countryside, Dublin is a leading tourist destination, welcoming millions of travellers every year. However, besides the tourists, international companies have also flocked to the city – attracted in particular by its tax incentives and highly skilled, English-speaking workforce.

In absolute terms, and beyond total number of headquarters, Dublin has received the most foreign investment projects in Europe over the past five years, after London, Paris and Berlin.

Most of this investment has gone into software and IT services, followed by business services and financial services. Major tech companies such as Google, Facebook, Airbnb, PayPal, Microsoft, eBay, LinkedIn and others have set up their European headquarters in the Irish capital.

Advertisement

UK-based Softcat, a value-added IT reseller that is expanding its Dublin headquarters, says: “Since establishing a local presence in Ireland, we have more than doubled our Irish business. As well as the business prospects here, Ireland represents a great recruitment opportunity, with a highly skilled workforce and a vibrant tech scene.”

Amsterdam's attraction

Amsterdam is the second top destination for foreign investment in headquarters. Beyond the city’s canals and cafe culture is a thriving financial centre and tech environment.

Amsterdam is Europe’s fifth top city destination for foreign investment, beyond just headquarter projects, over the past five years, according to fDi Markets. Most FDI to the city has gone into software and IT services, business services, financial services and the communications industry.

More than 3600 international companies have invested in the Amsterdam area, with 1000 of these – such as Netflix, Uber and Tencent – choosing the city as a headquarter location, according to Amsterdam’s official portal website.

The city has benefited from a slew of relocations caused by the uncertainty surrounding Brexit, with Sony and Panasonic both moving their European headquarters from London to Amsterdam.

Hot on Amsterdam’s heels is Reading in England, Europe’s third best destination for foreign investment in headquarters. Despite a population of just 220,000 people, the university town has one of the UK’s brightest tech scenes, as well as significant financial services, renewable energy and bio-pharma sectors.

Reading’s Green Park business park houses the UK headquarters of Microsoft, Huawei, Oracle and Thales Group, a France-based provider of technology services for the space, defence, security and transportation industries.

UK leads country list

The UK is Europe’s leading country for foreign companies setting up headquarters, based on the top 10 cities from fDi’s Top Headquarter Locations in Europe. Analysing the top 30 cities, the UK also comes out on top, thanks to the scores of Reading, Warwick, London, Belfast, Edinburgh, Bristol and Glasgow. In second place is the Netherlands, as it includes Amsterdam, the Hague, Utrecht and Rotterdam.

In joint third place is Ireland (with Dublin, Galway and Cork), Germany (with Munich, Düsseldorf and Frankfurt) and Spain (with Barcelona, Madrid and Malaga). Investors were attracted to the above cities by a combination of financial incentives, quality of life and skilled labour, especially in tech and financial services.

This article first appeared in the April-June edition of fDi Magazine.