The development of renewable energy in Latin America touched new heights in 2016 when Spanish company Solarpack offered the lowest price on records (2.9 cents per kilowatt-hour [kWh] without any public subsidy) in a public auction to develop a 120-megawatt photovoltaic (PV) solar plant in northern Chile. Although that record would soon be beaten by a project in Abu Dhabi, which fetched a new lowest ever bid of 2.42 cents per kWh, it reiterated Latin America’s position at the forefront of global renewable energy development.

Power developers from all over the globe have rushed to the region to explore its potential for wind, solar, small hydro, geothermal and biomass energy over the past few years. And they have found abundant resources, a growing demand for electricity, and sound legislative frameworks that, despite generally refraining from the generous feed-in tariff schemes typical of other regions such as Europe, have paved the way for a green revolution that has been able to gradually diversify the energy matrix away from fossil fuels and large hydro power.

Advertisement

World beaters

Since 2004, renewable energy investment in Latin America (excluding large hydro power) has grown 11-fold, in comparison with a six-fold increase worldwide, according to Bloomberg figures.

A number of major Latin American countries such as Brazil, Mexico and Chile have emerged at the forefront of global renewable energy developments when it comes to the scope of investment and end results. Smaller countries are also performing well, with Uruguay boasting the world’s highest ratio of installed wind energy per capita, and El Salvador being second only to Iceland for the specific weight of geothermal generation in its energy matrix.

Others are now striving to join this pack – first and foremost Argentina, where the new government, led by president Mauricio Macri, has launched a programme that has seen the first public auctions for renewable energy projects be largely overbid, despite the country’s poor reputation when it comes to long-term financial commitment.

Pioneering solutions

Advertisement

Intense economic growth and urbanisation has led to a steep growth in energy demand across Latin America in the past two decades. Local governments have bet on renewable energy to meet part of this growing demand and better diversify the energy matrix against the backdrop of quickly rising fossil fuel prices, a trend that reversed in 2014, and recurrent droughts, which have heavily affected hydro-based generation.

They have done this by approving “pioneering” solutions to regulate the industry and make it one of “the most dynamic and diversified environments for electricity markets” in the world, the International Renewable Energy Agency (Irena) said in a report in 2016.

Today, the largest economies in the region have liberalised their power markets at a wholesale level, and even at a retail level in the case of Colombia, spurring competition and investment in the sector. They have also pushed the introduction of renewable energy generation by setting mid- and long-term targets for renewable energy generations and widely relying on public auction schemes to incorporate clean energy in the system. These regulatory efforts have paid off.

Chile warms to renewables

“At the beginning the big power producers lacked the experience and the interest of developing renewable energy projects,” says Chile’s former energy minister, Marcelo Tokman. “On the other hand, financial institutions felt unease in dealing with small producers using non-traditional technologies. The market needed a push to get over those hurdles, and that came in the form of a law [approved in Chile in 2008] that made it compulsory for any power supply contract to incorporate a certain percentage of renewable energy.”

Chile’s renewable energy legislative framework set in motion a historic change in the country’s energy matrix and contributed to partially alleviating its long-standing dependence on energy imports. Installed capacity of renewable energy stood at more than 4 gigawatts at the end of 2016, or more than 14% of total capacity, up from 4.8% four years earlier.

Chile’s success stands out in a region that has experienced an intense development of renewable energy all the way from Mexico to Argentina. Installed capacity of non-hydropower renewables in Latin American has more than tripled, to 36 gigawatts in 2015 from 10 gigawatts in 2006, according to Irena’s figures. In 2015 alone, wind, solar, small hydro, geothermal and biomass plants accounted for half of the 13 gigawatts of new capacity added in the region.

Total clean energy investment in Latin America amounted to $21.9bn in 2016, down by 6.8% from a year earlier, but still the second ever best performance, according to Bloomberg. Brazil held the lion’s share with $10.7bn, followed by Mexico ($4.1bn) and Chile ($3.4bn). Foreign investors have played a pivotal role in creating momentum for the development of renewable energy in Latin America, with the likes of Italy-based Enel Green Power, Ireland's Mainstream and Spain's Acciona, and a growing number of Chinese developers deeply involved in the development of solar and wind power plants across the region.

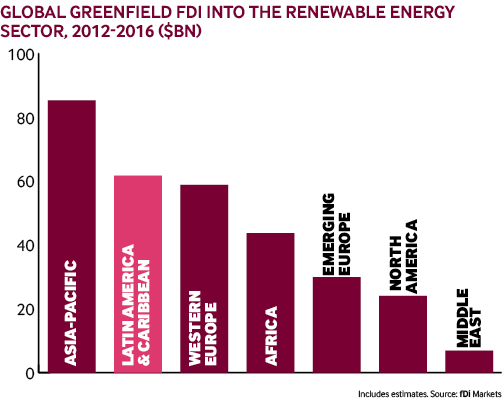

Overall, foreign investors have announced clean energy projects worth more than $61.6bn in the past four years, a figure second only to the Asia-Pacific region, where announced projects reached $85.2bn, according to data from greenfield investment monitor fDi Markets.

On the rise

On the back of such stellar performances, Latin American countries look set to continue to make big strides towards achieving their renewable energy targets and reducing their dependence on traditional energy sources. Chile ranked as the world’s fourth most attractive country for renewable energy developments behind the US, China and India, according to a study published by consultancy EY in 2016, and another 4.7 gigawatts of renewable capacity is expected to be developed in the country in the next three years. EY’s study put Mexico and Brazil in sixth and eighth position, respectively. Meanwhile Argentina is quickly climbing the ranking and currently stands in 16th place – it did not feature in the top 40 places in 2015.

Argentina's new government stirred the interest of energy developers with its two energy auctions dedicated to renewable energy in 2016. Both were overbid and, eventually, the government awarded 59 projects representing new installed capacity of 2424 megawatts and private investment in the range of $4bn, according to figures from the energy and mining ministry. If Argentina’s potential for wind and solar power has long been known, a 20-year dollar-denominated power purchase agreement, locked in by multiple layers of guarantees tracing all the way back to the World Bank, convinced investors to ignore any preconceptions they had over the country’s poor reputation when it comes to financial commitment.

“Those levels of guarantee are necessary because Argentina is still perceived as a country with high risk,” says Daniel Redondo, Argentina's energy planning secretary. “However, we hope that in the future the country’s risk decreases and those levels of guarantee won’t be necessary any more.”

A new round of public auctions to award new supply of clean energy is now in the works and expected to kick off in April.

Affordable tech

With renewed political commitment coming from Latin American authorities to develop clean energy, falling technology prices are further widening the room for new projects to secure financing and come online.

“Renewables in Latin America are making strides in terms of cost-competitiveness,” Irena wrote in 2016. “The levelised cost of electricity has decreased by more than 50% for solar PVs since 2012, and by about 20% for hydropower and onshore wind since 2010, ranking among the lowest globally and increasingly competitive with fossil fuels.”

All the factors are falling into place for a new wave of renewable energy developments to unfold in Latin America. The sector is already a bright spot in the bleak economic landscape the region is otherwise enduring. Beyond its contribution to energy security and the environment, it employs about 2 million people and has the potential to shore up economic growth for the years to come. Going green, it seems, looks set to pay off for Latin America.