Uzbekistan has entered the new era of president Shavkat Mirziyoyev with a glimpse of hope that the government’s long-standing protectionist policies – which have yielded stability and a certain degree of economic diversity, but largely isolated the country – will gradually be reviewed.

After the brief transition that followed the death of Islam Karimov, who steered the country outside the Soviet Union and led it with a strong fist during its first 25 years of independence, Mr Mirziyoyev officially secured the presidency on December 4, in elections that, expectedly, lacked a “genuine political debate”, according to European observers. He is widely considered to be a force for continuity from Mr Karimov’s era (Mr Mirziyoyev served as Mr Karimov’s loyal prime minister for the past 13 years) rather than change, but there is a lingering feeling among the Uzbek population and business community that the time is ripe for much-needed reforms – first and foremost, in the foreign exchange regime.

Advertisement

“The government is taking on more of an evolutionary approach rather than a revolutionary approach,” says Nail Hassanov, founding partner of Tashkent-based law firm Kosta Legal. “There will not be immediate changes, but changes are inevitable.”

Economic pressure

Uzbekistan’s capital, Tashkent, looked a dormant city, with the typical features of Soviet architecture and urbanism, on an autumn day a few weeks before the country’s elections. The death of Mr Karimov in September caused grief, but did not represent much of an inflection point in the day-to-day life of the city’s 2.1 million inhabitants. Stability has long been the government’s mantra, come what may, and that stability has been preserved in the aftermath of Mr Karimov’s death in September, which saw the rise of Mr Mirziyoyev as interim president before clinching the presidency in the elections.

Yet Uzbek authorities are feeling economic headwinds. “There is a sense of economic pressure in the country,” a top diplomat in Tashkent told fDi Magazine under condition of anonymity. “It’s been felt for the past two years. That’s creating the need for economic reforms.”

The government maintains the country has been largely resilient to the drastic economic slowdown that central Asia as a whole has experienced since oil prices collapsed in the second half of 2014. Economic growth remained pretty much stable at 8% in 2015, in line with the previous nine years, and annual inflation did not exceed 5.6%, according to contentious official data. However, there is little sign of booming economic activity. In fact, external trade weakened, the flow of remittances from Russia plummeted, and major projects in the hydrocarbons industry are reportedly on hold. “Growth [in 2015] was expected to be lower,” the Asian Development Bank said in its 2016 Asian Development Outlook report.

Foreign exchange reform

Advertisement

At the same time, there are widespread signs of growing inflation pressures in Uzbekistan, stemming largely from the depreciation of the som. The government’s tight foreign exchange and capital controls heavily limit the capacity for profit repatriation by foreign investors, as well as the room for manoeuvre afforded to exporters and importers, and create room for the development of a flourishing black market.

In a trend reminiscent of Argentina in the final years of Cristina Kirchner’s presidency, the gap between the som’s official rate and the street rate has been widening, suggesting a mounting shortage of foreign currency reserves. Today, the ‘street’ som is worth less than half of what it used to be a couple of years ago, changing hands at about UZS7000 to the dollar on any street corner.

On the other hand, the official exchange rate offered by the central bank still stands at UZS3175 to the dollar. Besides, companies reportedly have to wait months to receive hard currency through official channels, and often receive only a fraction of what they had originally asked for as authorities give priority to requests fitting the national industrial agenda, as well as other vested interests.

The issue has long been the elephant in the room in Uzbekistan, and Mr Mirziyoyev somewhat surprisingly decided to address it in late November by unveiling a decree to liberalise the exchange rate, loosen capital controls and level the playing field between local and foreign investors, all before election day. The decree is available online for public scrutiny and feedback until December 14, in what appears to be another step forward from the closed-door decisions that were typical of Mr Karimov’s tenure.

Expectations are high that any improvement in the foreign exchange regime will gradually unlock Uzbekistan’s economic and investment potential. “The availability of hard currency is the biggest issue [affecting the economy today],” says Kosta Legal’s Mr Hassanov. “Should it be resolved, we expect the Uzbek economy to boom.”

Tight foreign exchange and capital controls have long been engineered to support the country’s industrial policy, which is aimed at stimulating import substitution and supporting the export of manufactured products. This approach has achieved some economic diversity. The development of a local automotive industry from the ground up is certainly a source of pride among local politicians. In 2014, global brands such as General Motors and Isuzu produced about 250,000 vehicles in the country, most of them equipped with locally produced engines. “Uzbekistan is the only country in the post-Soviet space that succeeded in increasing the share of industry in GDP,” stated a UN paper published in 2016.

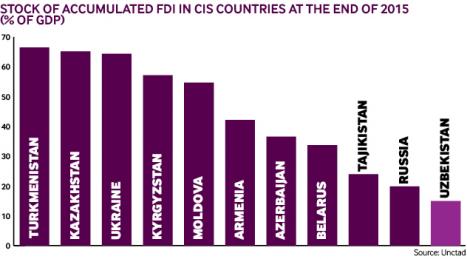

On the other hand, it hardly made Uzbekistan a champion of FDI. Despite its endowment of mineral reserves, and a market of more than 30 million people, the country’s stock of accumulated FDI stood at $9.9bn at the end of 2015, or 15.01% of GDP, the lowest level among Commonwealth of Independent States countries, according to figures from Unctad.

Some Western investors that ventured through the country’s business environment have been embroiled in the rampant corruption of the ruling elite. Swedish TeliaSonera and its Amsterdam-based peer VimpelCom were both fined hundreds of millions of dollars by courts in the US and the Netherlands for handing out bribes to a company tracing back to Mr Karimov’s daughter, Gulnara, to secure local mobile licences. Russian peer MTS was also involved.

Worth the risk?

Despite its risks, Uzbekistan continues to stir the interest of investors with an eye for risky plays in frontier regions. “Today there is a shortage of countries such as Uzbekistan that are politically stable, where economic fundamentals are good, but that haven’t experienced too much economic development yet,” says Sebastian Nokes, a British investor.

Asian investors have long recognised this potential. South Korean and Chinese companies in particular are relaxed about doing business in the country, investing billions in large projects blessed by agreements struck at a political level, mostly in the hydrocarbons and infrastructure sectors. Any further opportunities for foreign investment will not diverge from the country’s approach to industrial policy, but continue to target sectors fitting in the government’s overall vision. “We look at FDI for the transfer of technology and management skills,” a spokesperson for local IPA, Uzinfoinvest, says, pointing out that FDI promotion remains central to policies aimed at substituting imports and boosting exports in sectors such as the food industry, pharmaceuticals and the processing of raw materials.

The foreign exchange reform or an ongoing privatisation programme are among first steps in the direction of increasing the country’s foreign investment appeal. Other measures such as the development of special economic zones, and legislative reforms on governance, public procurement and international arbitration are also in the making. Besides, Mr Mirziyoyev introduced a visa-free regime for tourists from 15 countries and visitors over 55 years from another 12 countries. Things will not happen overnight, but are already moving forward at a faster pace than forecast.

“If you would like to have a good crop, don’t rush. You have to sow the field, and make sure you give it water at the right time,” Shaykhov Alisher Erkinovich, chairman of the national chamber of commerce and industry, told a British trade delegation in November. “If you rush, you get nothing.”

Mr Mirziyoyev has a chance to sow the seeds of change. Uzbeks will be waiting for the harvest.