If 2018 was ‘the year of sustainability’ as far as marketing trends and consumer demand in the global textiles industry is concerned, 2019 will be remembered as the year it listened and responded.

It is impossible to ignore the extent to which consumer demand is influencing the map of FDI as fashion brands compete to find the most attractive ‘Made in...’ label. Suddenly European countries such as Italy and Spain have become attractive destinations once more for FDI in the sector. “Ninety percent of our supply chain is in Italy,” Marie Claire Daveu, chief sustainability officer of Kering Group, said in a previous interview with fDi.

Advertisement

Eco-friendly jeans

US retailer Gap’s recent announcement of an initiative to manufacture eco-friendly denim has resulted in a new partnership with Spanish mill Tejidos Royo. The new innovation of ‘dry indigo’ is expected to reduce water usage by up to 99%, and uses 89% less chemicals and 65% less energy during production.

Gap has also pledged to manufacture all of its denim across its various brands from sustainable sources by 2025. This comes after a prediction by Orsola De Castro, co-founder of not-for-profit global movement Fashion Revolution, in a 2018 FDI trends report, that being ‘sustainable’ and ‘ethical’ would be viewed as a ‘value-added asset’ in textiles production.

There have been three critical factors that have shaken the industry to its core over the past year. The first has been the cultural shift towards sustainability – not only as a buzzword, but as a key macro-economic indicator of transparency, efficiency and a measure of safeguarding long-term profitability. The second has been the industry’s demand for the development of new innovative materials – triggering a greater interest on a macro-level in investment in biotech and materials with a low environmental impact.

The third has been a combination of geopolitics and logistics. The overspill of the ongoing trade war between China and the US – two of the largest manufacturers and consumer markets for textiles and apparel – has forced other stakeholders in the industry to re-evaluate their supply chain.

Saisangeeth Daswani, head of advisory for fashion, beauty and Asia-Pacific at sector analyst Stylus, says that just as geopolitics and logistics are driving current global trends in manufacturing more generally, these factors are also playing a role in FDI trends for textiles.

Advertisement

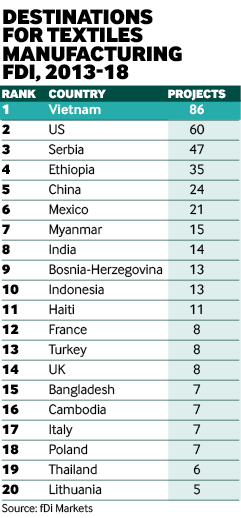

Noticeably, Vietnam has beaten the US into second place in the number of FDI textiles manufacturing projects attracted between 2013 and 2018 at 86, according to greenfield investment monitor fDi Markets. Meanwhile, Serbia has retained its third position and Ethiopia has now surpassed China, which has slipped into fifth place. As China continues to grapple with tariffs and a mounting trade war with the US, other countries are seizing the opportunity to compete for new investment.

New tech techniques

However, while China may not be the top destination for textiles manufacturing FDI, as a source country it is already making waves in investment in biotech and sustainable textiles. The latest figures for FDI for the newest projects and expansions in late 2018 illustrate this. Most noticeable of all the projects is the $2.5bn development by Chinese-owned chemical company Cathay Industrial Biotech into Kazakhstan, where it will be developing a new facility to manufacture nylon by processing wheat and maize.

China – once one of the most competitive players in the fast fashion sector – is already making decisive investments into biotech, indicating that the industry’s shift towards producing sustainable low-environmental-impact materials is more than a passing trend. As more European companies adjust to customers’ aversion to plastic-based materials, this new facility is expected to produce a capacity of 500,000 tonnes annually, which could ensure that China is well positioned to meet the changing demand for sourcing materials.

Another key player in the regenerative textiles game is Tencel Lyocell branded fibres produced by Austria-based Lenzing Group, an industry leader in the mass production of lyocell. In the final week of June 2019, Lenzing announced a new FDI project in Thailand worth $332m due to open in late 2021 with the expectation of producing a volume of 100,000 tonnes per year.

This project had originally been destined for Alabama in the US, but as a result of the fallout from the Trump administration’s stance on climate change and its ongoing tariff war with China, Lenzing switched the location of this new site to Thailand. The firm now supplies manufacturers such as Inditex, Levi's, Ted Baker, Pottery Barn and H&M (see Company Profile, page 14).

The $45.8m investment into Finland’s growing regenerative industries by Japanese conglomerate Itochu is another signal that innovation in textiles manufacturing is a hot topic. This joint venture with Finland-based Metsa Group, a wood and pulp manufacturer, will develop a new technology for converting paper trade pulp into textiles fibre.

Antipathy in the UK

While the UK is a hub for the growing market of sustainably produced textiles, there is increasing tension within the industry between activists, manufacturers and politicians. In the wake of the 2019 Environmental Audit Committee (EAC) textiles report Fixing Fashion, Mary Creagh, a UK member of Parliament and chair of the EAC, expressed her disappointment that the UK government announced in June 2018 that it will not implement any of the committee’s recommendations for legislation or supply-side policies incentivising producers to be transparent and ethical in their methods of production.

This call for government intervention in the UK textiles manufacturing industry comes at a critical point, as the UK’s fashion industry is now the fastest growing sector in the country's economy (as part of the creative industries) employing 890,000 people, according to the British Fashion Council (BFC). The sector is projected to generate £76bn ($92.6bn) in GDP by 2023 according to the BFC, all of which is adding to the calls for the industry to come under closer scrutiny. Indeed, in May 2018, the Financial Times reported on modern slavery and sweatshop conditions occurring in textiles factories in Leicester.

At a recent industry summit in London addressing industry leaders, Robert Skinner, executive director at the UN office for partnerships, stated that the fashion industry, as both one of the world's biggest polluters and drivers of modern slavery, has a responsibility in ensuring the UN’s 17 Sustainable Development Goals are delivered by the deadline of 2030.

The increased involvement of the UN at industry level was also noticeable at Pure London, the UK’s biggest textiles event, in February. Furthermore, the recent campaign with London-based social enterprise Bottletop, with the launch of its ‘Together Band’, further disseminates the message and expectation that ‘sustainability’ and ‘ethics’ are more than value-added assets to the industry but must now become standard practice.