Nitra, a quiet city some 100 kilometres east of Slovakia’s capital Bratislava, hit the headlines in 2015 when it suddenly emerged as Jaguar Land Rover's choice for a new production facility. One of the largest ever greenfield investments in the European automotive sector, the project is expected to draw FDI from Jaguar Land Rover worth about $1.45bn and foster the development of a whole local ecosystem catering to the needs of the new production facility.

It was no accident that Slovakia came up on the radar screen of the Indian-owned automotive group. Global car powerhouses such as Kia, PSA Peugeot Citroën and Volkswagen have been manufacturing in the country for years, taking advantage of its favourable location, low labour costs and, more recently, of the introduction of the euro as its currency in 2009.

Advertisement

Economic kick-start

The Jaguar Land Rover commitment is now expected to drive new investment momentum across Slovakia and strengthen the country’s role as an FDI destination in central and eastern Europe (CEE), a feature that local authorities plan to emphasise during the upcoming six-month Slovak presidency of the EU, which will gain the young republic plentiful regional and international exposure.

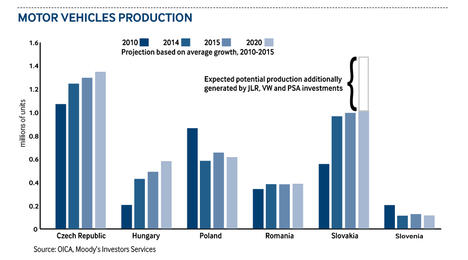

“A new wave of investments in the Slovakian automotive sector is expected in 2016 to 2020, following announcements by Jaguar Land Rover of the new plant, and by Volkswagen and PSA Peugeot Citroën of existing plants to be enlarged,” credit rating agency Moody’s said in a report in May.

The car industry is the undisputed backbone of Slovakia’s economy. The 'big three', as the local press often describes Kia, PSA Peugeot Citroën and Volkswagen, produced a record 1.04 million vehicles in 2015, according to figures from local automotive industry association Zap. They make up about 44% of the country’s industrial production, or 12% of the overall GDP, and employ more than 125,000 people. Production will remain at about 1 million vehicles in 2016, until Jaguar Land Rover’s new facility comes online in 2018.

In a first phase, the Indian-owned group will produce some 150,000 units of its all-new aluminium vehicles in Nitra. Combined with Volkswagen and PSA Peugeot Citroën expansion plans, “when plants progressively reach full capacity in 2018 to 2020, the investments should increase car production in Slovakia by 300,000 to 500,000 units per year”, said Moody’s. This would allow Slovakia to close the gap with neighbouring Czech Republic as the top car producer in the CEE region (see chart).

Back on the map

Advertisement

The new wave of investment into the automotive industry has turned the page on the challenging years that followed the 2008/09 financial crisis, when FDI inflows into Slovakia fell to 2.1% of GDP between 2009 and 2014, from 7.8% between 2004 and 2008, according to Eurostat figures. FDI into greenfield projects jumped to $3.4bn in 2015, from slightly below $1bn a year earlier, according to figures from global investment monitor fDi Markets.

“The global slowdown, with investors generally [being] more careful, is over. Slovakia is very much back on the map,” says Róbert Šimončič, CEO of Slovak investment promotion agency Sario.

With most countries in the region sharing a common denominator in terms of logistics value and labour cost savings, Slovak authorities leveraged off some of the country’s key selling points to lure Jaguar Land Rover into preferring Nitra over alternative locations in the Czech Republic, Hungary or Poland.

“The euro is a big factor, because we are the only ones [among our neighbours, except for Austria] that belong to the eurozone. That has been a big winner for us as it makes cash flows more predictable, whereas currency fluctuations in economies that are not yet well established can push your costs up or down by 30%. It’s challenging,” says Mr Šimončič.

At the same time, Slovakia is gaining ground against its direct competitors as its business environment has been improving over the years. The country now ranks 29th out of the 185 featured in the World Bank’s latest Doing Business report, up from 49th two years ago. Slovakia has also broken into the world’s top 10 countries for its capacity to turn FDI into technology transfer, as tracked by the World Economic Forum. The country's improving business environment and high levels of technological transfer helped sustain labour productivity gains, which largely offset wage increases in recent years and prevented the country from losing price competitiveness, the European Commission noted in a February report.

Additionally, Slovakia’s authorities have showed their commitment to accommodating big foreign investors with plenty of state support for their investment. The national government injected a €130m investment stimulus for the Jaguar Land Rover project, which stands at the “limit” of what is allowed under EU rules, a local source tells fDi Magazine. At the same time, Nitra’s local municipality is assessing local tax incentives for the company, according to mayor Jozef Dvonč.

The pay off

These efforts may well pay off in the mid term, as the Jaguar Land Rover plant will provide a cumulative growth contribution of about 1.6% to 2% between 2016 and 2020. Slovak authorities expect real GDP growth to accelerate above 4.5% starting from 2019, compared to a scenario where growth would be 3.5% without the new investments in the automotive sector.

The government is emerging from a delicate political transition following parliamentary elections in March, which eventually confirmed Robert Fico at the head of the cabinet. It is now gearing up to receive the EU rotating presidency in July. This will give the country a chance to promote its business proposition to foreign investors beyond the automotive sector.

A new branding campaign by the foreign ministry put particular emphasis on Slovakia as a 'good idea' for foreign investment. Electronics powerhouses such as Samsung and Foxconn are already active in the country, and the Slovak ICT sector is trying to gain its share of the growing outsourcing and shared service centre industry in eastern Europe.

“Now we are really looking at the higher value of their offer when we start talking with ICT companies. And with the new EU funding programme, we can invest more in R&D and build infrastructure that we can use as a potential plug-in for investors," says Mr Šimončič.

Slovak authorities have yet to address chronic weaknesses such as corruption and bureaucracy which remain at the top of investors’ concerns, as shown by a World Economic Forum survey. The regional divide is also another challenge, with eastern and southern regions in particular lagging behind the country’s industrial and economic heart developing around capital city Bratislava. Eventually, higher transparency, geographical and economic diversification could make investment in Slovakia an even better idea.