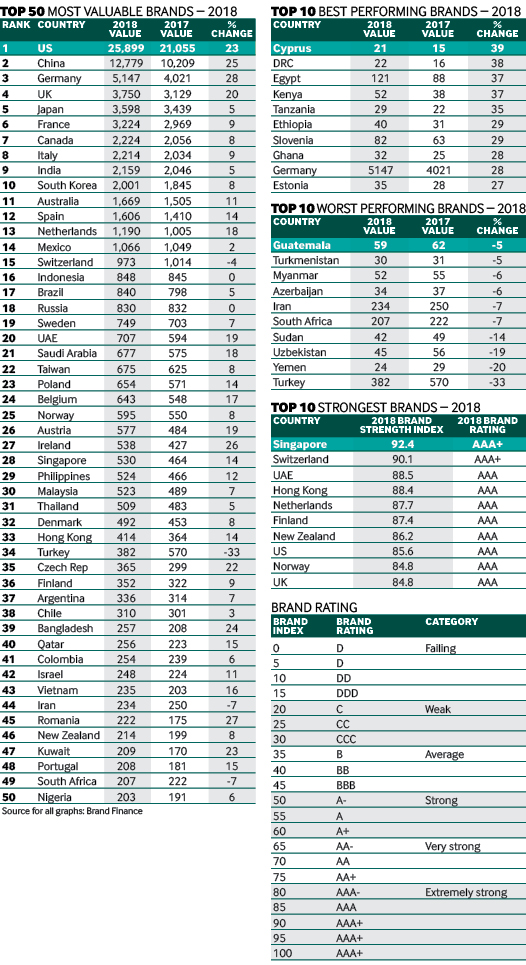

Nation Brands ranking 2018

The US is once again Brand Finance's most valuable nation brand, while China, Germany and the UK witnessed strong brand growth too.

For better or for worse, brand recognition is a high priority for consumers when buying products. The same applies when companies consider their next expansion destination. To compile the Nation Brand rankings, the consultancy Brand Finance measured the value of the nation brands of 100 leading countries using a method based on the royalty relief mechanism employed to value the world’s largest companies.

As in previous rankings, the US has the world’s most valuable nation brand, beating its closest competitors China, Germany and the UK, respectively, by two to fivefold margins. The US economy has experienced strong growth in GDP, consumer sales, construction orders and car output. Meanwhile, falling tax rates have created a more business-friendly environment.

Download a PDF of this report here:

US still leads

“As Donald Trump approaches the start of his third year at the White House, in the longer run negative perceptions of his personal brand have turned out to have little impact on the nation brand as a whole. Rather, the new free-market policies have resonated with business leaders and the economy is growing, driving an improvement in the US's brand strength and brand value alike,” says David Haigh, CEO of Brand Finance.

Meanwhile, China’s brand value has shot up 25% year on year, despite trade war fears. Booming cities such as Beijing and Shanghai, which boast world-class infrastructure and well-educated workforces, are considered some of world’s best places to do business. “China is stepping up its role on the global stage, championing free trade and leading the efforts to combat climate change at a time when the US is turning towards protectionism and prioritising own interests over a collaborative energy policy,” says a statement from Brand Finance.

Germany has solidified its place as third top global brand. The country leads Europe with the fastest growing brand value in the top 50, up 28%, as it takes a bigger global role both economically and politically.

The UK is in hot pursuit of its European neighbour – despite Brexit uncertainties its brand value has increased 20%. “[This] shows that perceptions of Brexit go against the economic reality. What the exact scenario and consequences of exiting the EU will be still remains to be seen, but both current market conditions and economic forecasts for the coming years reaffirm the UK's ability to make the most of its post-Brexit future,” says Mr Haigh.

Outside the norm

The countries that have seen the greatest improvement to their brand – the best performers – are Cyprus, the Democratic Republic of Congo, Egypt, and four other African countries. Similarly, many of the best performers in the overall top 50 are from emerging markets, such as Saudi Arabia, Bangladesh, Kuwait, the United Arab Emirates, China and Qatar. Twenty-nine countries of the top 50 are from outside Europe and North America.

The table for the top 10 worst performing brands features many from central Asia or the Middle East – Iran, Turkmenistan, Azerbaijan, Azerbaijan – but Turkey has witnessed the greatest losses to its brand following contentious national elections, a diplomatic spat between with the US and a volatile Turkish lira.

“Turbulent political times in the wider region, such as the ongoing crises in Syria and Iraq, have also played a part. The mission ahead is to nurture global Turkish brands, such as the national carrier Turkish Airlines, which has shown a promising rise in its brand value since last year, up 6% to more than $2bn,” says Brand Finance.

In addition to measuring overall brand value, Brand Finance has also evaluated the relative strength of nation brands, determined by their performance on dozens of data points across three key pillars: goods and services, investment and society.

The top 10 strongest brands by this measure are led by Singapore, Switzerland and the UAE, respectively, as in 2017’s Nation Brands report. The top 10 is mostly made up of Western countries, with Hong Kong, Singapore and the UAE the exceptions.

As the strongest national brand, Singapore is a well-educated nation and the recognised technology hub in Asia. Indeed, Facebook has just announced plans to open its new data centre in the country in 2022. While also boasting excellent infrastructure and a high quality of life, Singapore is ideally positioned for connections with China, Hong Kong and Australia, according to Brand Finance.

Brands vs FDI

There is a clear link between world-class nation brands and world-class FDI. The parallels between the top 30 most valuable national brands and the top 30 destinations for greenfield FDI in 2017 is apparent, but not across the board, due to some interesting discrepancies, using data from greenfield investment monitor fDi Markets.

Some countries that have become magnets for foreign investment over the past decade, such as Mexico, Poland, Vietnam, Egypt and Morocco, have fast-growing investment hub statuses but their brand positions do not yet reflect how much investment they are pulling in. For example, Mexico was the seventh top global destination for greenfield FDI in 2017, while Poland came 10th, Vietnam 15th, Morocco 35th and Egypt 40th, according to fDi Markets. However, when it comes to brand rankings, Mexico is 14th, Poland 23rd, Vietnam 43rd, while Morocco and Egypt fail to make the top 50.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.