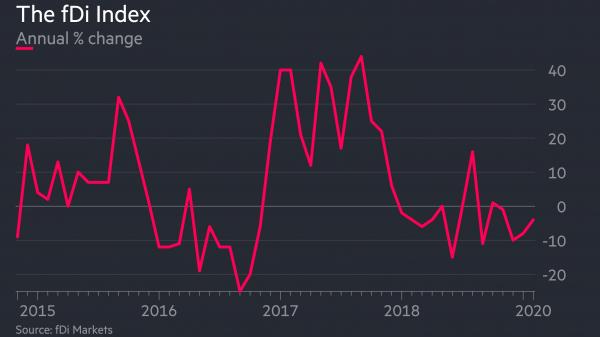

Companies around the globe appeared conservative in their foreign investment decision making in January as they carried the weak sentiment that persisted throughout 2019 into the new year.

The fDi Index, a proxy of the sentiment of foreign investors built as a measure of the announced projects and investment signals tracked monthly by the FT’s foreign investment monitor fDi Markets, fell to a reading of 861.1 in January, down by 4% from the same period in 2019.

Advertisement

Several major challenges weighed in the mind of foreign investors going into 2020 with trade tensions, protectionism and geopolitical risks expected to continue throughout the year, whereas the Covid-19 pandemic abruptly emerged as the black swan nobody saw coming.

Global events

“Global events are having significant implications on greenfield FDI flows. The UK is experiencing a sharp fall in inbound investment so far in 2020 in light of officially exiting the EU,” says Glenn Barklie, head of benchmarking services at fDi Markets.

“Investors are sceptical and generally have a ‘wait-and-see’ mentality concerning events outside of their control. Going forward, the Covid-19 outbreak is expected to disrupt greenfield FDI plans. Many site visits and events are being postponed to at least the second half of the year."

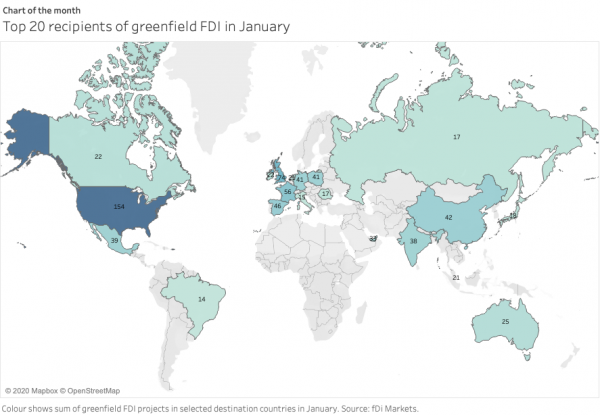

In this volatile environment, foreign investors preferred to place their bets on developed markets over developing markets. FDI into western Europe and North America made up almost half of the 1090 announced projects tracked by fDi Markets in January, while the Asia-Pacific region accounted for about a fifth of total projects. The US confirmed its status as both the biggest recipient, as well as the biggest source, of global FDI.

Advertisement

Chinese woes

Announced projects into China plummeted to only 42 as authorities rushed to quarantine the city of Wuhan on January 23 to contain an emerging Covid-19 outbreak. Only two days earlier, South Korean biopharma company Celtrion had announced a Won600bn ($503.9m) investment into a biologics plant in Wuhan. Celtrion’s was the only FDI project recorded throughout the Hubei region in January.

Outside China, major investors still appeared keen to announce FDI projects. Despite the troubles that led to the demise of founder Adam Neumann and sank its IPO prospects in late 2019, WeWork continued to deepen its international footprint by announcing new co-working spaces in Japan (4) and China (3). In the energy sector, renewable energy producer Univergy stole the limelight as the Spanish company unveiled plans to develop up to 800MW of solar power installed capacity in Peru.

In the automotive sector, French PSA Group scored the biggest project of the month as it announced plans to develop a €2bn electric vehicle (EV) battery plant in Kaiserslautern, Germany – PSA thus followed in the US EV producer Tesla, which in November announced its plan to develop a $4bn battery plant in the outskirts of Berlin.

“What will be interesting is to see is the effect [of the current uncertainties] on projects currently being considered – reflected in our FDI Signals – and projects at the early stages. Overall, we are expecting greenfield FDI to fall in 2020 compared to 2019. The fDi Index could seem rather downbeat throughout 2020, certainly within H1,” says Mr Barklie.

Investment signals, which track investment intentions on a more strategic level before they turn into concrete FDI projects, held strong in January, signalling that investors are still keen to consider cross-border expansions, at least at a board level. Some major multination enterprises (MNEs) of the likes of Chinese handset manufacturer Xiaomi, South-Korean car producer Hyundai and US media company Netflix communicated early intentions to expand their presence in western Europe, whereas US food&beverage Pepsico and UAE logistics operator DP World expressed their commitment to further tap into the growth potential of the African market.