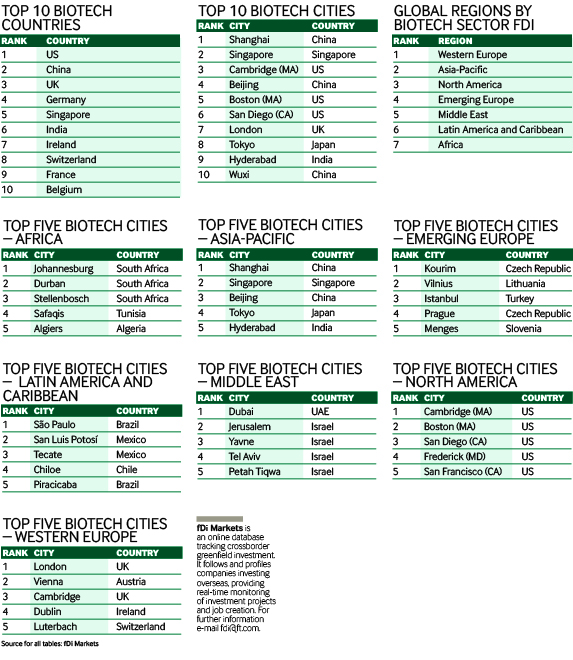

According to data from greenfield monitor fDi Markets, the number of biotechnology investment projects increased by nearly 110% between 2003 and 2016, while jobs and capital expenditure increased by 137% and 153%, respectively, both peaking in 2016. In a study of which locations are doing the best job at fostering the biotech industry, Shanghai ranks as the leading city for biotech FDI, followed by Singapore and Cambridge, Massachusetts.

Further reading

The battle for biotech rages on

Advertisement

Shanghai attracted 31 biotech investments in the period analysed, more than 35% of which were in sales, marketing and support operations. R&D investments accounted for nearly 30%, while education and training operations made up more than 16% of the city’s biotech FDI. The city attracted the highest number of jobs and capital investment in biotechnology of all cities globally.

Shanghai’s largest inbound biotech investment was announced in late 2009, when Switzerland-based pharmaceutical company Novartis invested $1bn in an expansion of its Institute of Biomedical Research in the city, creating 840 jobs. The city’s reputation as a biotech hub is cemented at the annual Shanghai Bio-Forum, which hosts exhibitions, panel discussions and keynote speeches, giving a comprehensive overview of the sector.

Singapore soars

While Shanghai attracted the greatest capital investment and the highest number of jobs in the biotech sector, Singapore recorded the highest number of projects. Forty-four investments were made in the city in the 14 years to 2016, creating more than 3500 jobs and representing investments totalling more than $2.3bn. US-based pharmaceutical Baxter established a drug manufacturing facility in the city in mid-2014, citing the infrastructure and regulations for doing business in the city as the main reasons behind its decision to invest.

Singapore’s Agency for Science, Technology and Research aims to bridge the gap between academia and business, while fostering and promoting talent for its research institutes. Its commercial arm, ETPL, aims to build strategic partnerships with businesses, co-develop products, facilitate licensing deals and to nurture start-ups.

Cambridge, home to world-renowned Harvard University and Massachusetts Institute of Technology, ranked third in the study. Twenty-three investments were made in the New England city, more than half of which were in sales, marketing and support operations. Five companies established their regional headquarters in the city, including Belgium-based Bone Therapeutics, which set up in the Kendall Square area of Cambridge. Companies in this area, which has been called “the most innovative square mile on the planet”, have received approximately $14bn in venture-capital investment, according to some reports. The company stated that the presence of the world’s 10 largest biopharma companies in the state was instrumental in its decision to invest.

Advertisement

Methodology

To compile the list of locations for this study, fDi Intelligence, a data division of the Financial Times, looked at the global data from greenfield investment monitor fDi Markets between January 2003 and April 2017. Locations were ranked on their record of investment in the biotechnology sector, considering project numbers, capital investment and job creation. Retail was excluded in this study. Data including project numbers, capital investment, job creation and FDI specialisation were scored from 10, with the highest values given higher scores, and weighted. The locations were then ranked based on the total scores.