Greenfield FDI into business process outsourcing (BPO) projects in Latin America and the Caribbean is soaked up largely by five key countries, a five-year analysis by fDi Markets shows.

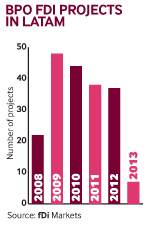

Between June 2008 and June 2013, a total of 196 FDI projects were recorded by the crossborder greenfield investment tracker. These projects represent a total capital investment of $823.67m. The best year for projects in this sector was 2009, with 48. Average project size peaked in 2012 for both capital investment and jobs created. BPO, for the purposes of this analysis, includes customer contact centre, shared services centre and technical support centre activities.

Advertisement

The big five

The top five destination countries account for the majority of projects. Costa Rica is the top choice, accounting for almost one-fifth of projects tracked. Brazil, Mexico, Colombia and Argentina are the next most popular destinations for investment, in that order. Beyond the top five, project numbers tail off substantially.

Mexico has received the highest number of total jobs and the greatest investment, with a total of 18,500 jobs and $336.9m in capital investment. Mexico also has the largest average project size in terms of both investment and jobs creation.

The top five destination cities also account for almost one-fifth of projects. San José (Costa Rica) is the top destination city, accounting for 7.1% of projects tracked. São Paulo has both the highest total and highest average investment at $100m overall. San José has received the highest number of jobs created, while São Paulo has the largest average project size, with 2482 jobs per project.

The most important factors behind destination choices made by investors are skilled workforce availability, regulations or business climate, and language skills. The most active investors have been Deutsche Post, France-based Teleperformance, US-based duo Convergys and Sykes Enterprises, Spain-based Telefonica, and Transactel of Guatemala. The US is the top source country by far, accounting for almost half of projects tracked.

As a sector, business services accounts for the majority of projects. Project volume in this sector peaked during 2012, with 28 projects tracked. Meanwhile, financial services has both the highest total investment and highest average investment at $371.9m overall and $124m per project. Business services has generated the highest number of total jobs, while financial services has the largest project size, with 3042 jobs per project on average.

Advertisement

Out of the three business activities included, customer contact centres account for almost two-thirds of projects.