In aerospace and aviation, success builds upon success. That was the case with Atlantic Aero, a general aviation services firm based at Piedmont Triad International Airport (PTI) in Greensboro, North Carolina. It expanded its expertise in engineering and R&D several years ago by test-flying a new kind of jet engine for Honda Motor Company.

Then, in 2007, officials from Honda Aircraft Company, a wholly owned subsidiary of Honda Motor Company, decided to take the prototype for a new advanced light jet off the drawing board and into the sky by announcing it would manufacture the HondaJet and establish its world headquarters in 23,225 square metres of new space at PTI. Completion of the facility is expected in February 2011.

Advertisement

“In total, we will have four acres [1.62 hectares] under one roof,” says Stephen Keeney, Honda Aircraft spokesperson. The company expects to have 600 employees to produce the $4.5m aircraft.

Honda Aircraft executives considered a number of locations across the US for the operation. However, PTI offered various benefits that sealed the HondaJet deal: good weather; the fact that, as of May 2009, logistics partner FedEx now operates its Mid Atlantic package hub from PTI; and Greensboro’s strategic location between Atlanta and New York.

“We were also very taken by the warmth of the community, both at the local and state level,” says Mr Keeney.

The company maintains relations with Atlantic Aero, and looks to Timco Aviation Services – one of the world’s largest independent aircraft maintenance, repair and overhaul providers (also located at PTI) – for special machinery. Nearby, Guilford Technical Community College offers an Associate of Applied Science degree in aviation systems technology, which provides an excellent source of highly trained employees.

Market performance

Aviation and aerospace is good business for communities, although as with other industries, it has felt some impact from the worldwide economic turbulence.

Advertisement

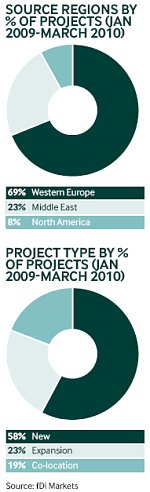

Between January 2009 and March 2010, greenfield investment monitor fDi Markets recorded 212 investment projects from 109 companies worldwide. Top investors were the European Aeronautic Defence and Space Company from the Netherlands (23 projects), and low-cost carriers Gol Linhas Aereas Inteligentes of Brazil (12 projects) and Ireland’s Ryanair (11 projects).

Ryanair is expanding with a second maintenance and servicing hangar at Glasgow Prestwick Airport in Scotland. Its $11.5m investment in the 6000-square-metre facility will create 200 engineering jobs when it opens in October 2010. Ryanair is also spending $140m to open a new hub in Kaunas, Lithuania.

Growth areas

Regarding the type of business functions associated with current investments, fDi Markets found that top of the list for January 2009 to March 2010 was sales, marketing and support (78 projects), followed by maintenance and servicing (46 projects) and manufacturing (40 projects).

In addition, fDi Markets found that the top three source markets for outward investment were the US, the Netherlands and the UK, providing 17%, 12% and 9% of investment projects, respectively. Key source regions were West-Nederland, South-east UK, São Paulo, Ireland and Connecticut in the US. The top cities were Amsterdam, São Paulo, Dublin and London.

The top three destination markets for inward investment were the US, the United Arab Emirates and Mexico, attracting 12%, 7% and 5% of investment projects, respectively. Dubai is the leading city, attracting eight inward investment projects from eight companies between January 2009 and March 2010. Following that, Singapore had five projects while Azerbaijan also had five.

The UAE and US remain resilient destinations for FDI projects in the aerospace sector, despite a global drop in project numbers. fDi Markets recorded 14 projects into the US in 2008, and this rose to 21 in 2009. Aerospace investments into the UAE increased from six in 2008 to 14 in 2009. In 2009, both the UAE and the UK experienced the highest number of aerospace projects since fDi Markets started recording projects in 2003. In contrast, aerospace projects in China have levelled off after an unusually high spike in 2008.

Making gains in Abu Dhabi In November 2009, ground was broken on a $1bn aerospace cluster adjacent to Abu Dhabi’s Al Ain International Airport to develop a major aerospace centre. The centre involves a joint agreement between the Abu Dhabi Airports Company (ADAC) and Germany’s bavAIRia Aerospace Cluster, which together will explore joint business opportunities in fields such as aero engines, aero structures, VIP interiors, satellite navigation applications, education and training.

Earlier in 2009, ADAC signed agreements with UK companies Beagle Aerospace and Generation Metals International. Beagle Aerospace will warehouse local spare parts at Al Ain to provide faster response times for aircraft-on-ground situations. Generation Metals International will offer supply chain management as well as an extensive range of aerospace metallics to businesses operating in the wider region.

Kevin Bolderston, managing director of Generation Metals, sees the move as offering the company further expansion overseas. “We see Al Ain as a key accelerator in our growth on the global stage,” he says.

Key factors behind the location of investment projects, according to fDi Markets, are proximity to markets or customers, and domestic market growth potential, cited by 45% and 41% of companies, respectively.

Take Montreal aircraft builder Bombardier Aerospace, for example. The company opened a maintenance base at Amsterdam’s Schiphol airport in October 2009 for its Learjet, Challenger and Global business jets, and plans to construct a Bombardier Center at Schiphol Aerospace Exchange to be completed in 2012.

The 4240-square-metre facility will be the first European service centre completely operated by Bombardier. It will employ about 50 technicians and be equipped to perform a variety of light to heavy maintenance tasks.

More than 40 European airports were considered for the centre, but Schiphol offered a top strategic location. Having its own location on the European mainland is an important strategic move for Bombardier as it gives the company the ability to handle all the maintenance for its growing fleet of more than 550 private jets.

“In the aviation sector, the quality and accessibility of the after-sales service is a deciding factor. The type of aircraft chosen is determined in part by the availability of a skilled and reliable service outlet, preferably operated by the maker of the aircraft,” says Jacques Comtois, general manager of Bombardier Aerospace Netherlands BV.

Magellan sets up in Wales

Meanwhile, Magellan Aerospace (UK), a subsidiary of Canada-based Magellan Aerospace, opened its new, reorganised $7.25m production facility in Wrexham, Wales, in December 2009. The project enables it to build the world’s most cost-effective aircraft wing spars.

Not only does the investment safeguard jobs at the plant, it allows Magellan to deliver a five-year contract for aircraft wing spars for the Airbus A320 and A330/340, and gives it an opportunity to win new business. About 2500 spars are expected to be produced every year.

“It is a significant investment for the company and will enable us to compete on the global stage for aerospace components,” says Magellan’s director of commercial and business development, Haydn Martin.

The company is planning on further investment in new equipment this year.