In April 2011, fDi Intelligence released its annual Global Outlook Report, which focused on FDI trends in 2010. In 2010 a 0.38% decline in greenfield FDI projects was reported along with declines of 16% in capital investment and 4% in job creation. A decline was first reported by fDi Markets in 2009 and it seems this trend is continuing through to 2011, although to a lesser extent. Between January and June 2011, fDi Markets recorded a 6% decline in the number of projects, while capital investment was down 10% and job creation 18%.

A 2011 half-year review provides a glimpse of the continuing trends, and a view as to where the market looks to be heading. Using data from fDi Markets, which provides real-time tracking of global greenfield investment, this report compares FDI from the first six months of 2011 to the same period of 2010.

Advertisement

Source Analysis

Recurring trend

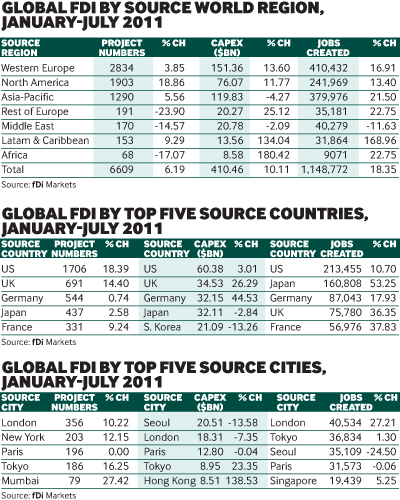

Western Europe has remained the top source region for FDI projects in the first half of 2011, accounting for 47% of global FDI, matching its market share for the same period in 2010. Western Europe, North America, Asia-Pacific and Latin America and the Caribbean all posted increases in outbound FDI.

In the first half of 2010, the ‘Rest of Europe’ region was the only one to experience an increase in outbound FDI projects. However, in the first half of 2011 the region invested in 24% fewer projects. Despite this, the Rest of Europe has increased the capital invested in overseas projects by 25% to $20bn and created more than 35,000 jobs, an increase of 23%.

Despite investing in fewer FDI projects in the first half of 2011, Africa has increased its investment capital by 180% and created an additional 1681 jobs, an increase of 22%. FDI from companies headquartered in Latin America in the first six months of 2011 fell in terms of project numbers but capital invested is up 134% to $14bn on the same period in 2010, and jobs have increased by 169%.

The Middle East continued its sharp decline as a source region. It experienced a decrease on all fronts with project numbers, capital invested and jobs created declining 15%, 3% and 12%, respectively.

Advertisement

Still top source

The US has remained the leading source country for greenfield FDI, a position held since fDi Markets began recording data in 2003. It accounted for 26% of global overseas projects in the first half of 2011. US-based companies also contributed 15% global capital invested in FDI and 19% of the estimated jobs created.

The top five source countries in terms of project numbers remained the same in the first half of 2011 as they were for the same period in 2010, with the UK in second place behind the US, followed by Germany, Japan and France. Of these countries, Germany recorded the highest increase in capital investments with a rise of 45%, while Japan created 160,808 jobs, an increase of 53% on the first half of 2010. All of the top five countries experienced an increase in terms of project numbers with the US also taking the top spot for capital invested and jobs created.

London looks abroad

Again London topped the source city table for the first half of 2011, with companies headquartered in the city accounting for 356 projects (5% of the global total), investing an estimated $20.5bn and creating more than 40,000 jobs. Ranked eighth for the same period in 2010, Mumbai increased its project numbers by 27%, which sees it rise to fifth in the source city rankings. The Tata Group, which is based in the city, has already made multiple FDI investments in the first half of the year helping to establish Mumbai as a vital source market.

Hong Kong increased its capital invested by 139%, more than doubling its spending to $8.5bn, while Japan-based companies created the most jobs after the US, increasing the Far Eastern country's job creation by 53%.

Destination Analysis

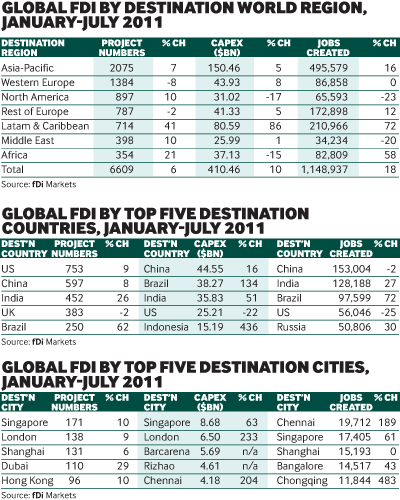

Attractive destinations

Asia-Pacific has maintained its position as the leading region as a destination for FDI. Project numbers, capital invested and jobs created have all increased. The region attracted a total of 2075 FDI projects for the first half of 2011, an increase of 6%. Capital invested in the region also increased by 5% with more than 68,000 jobs created, an increase of 16%.

Latin America is also on the up, with the region experiencing an influx of FDI. Project numbers in the region increased by 41%. Capital invested increased by 86% to $43.3bn and jobs created have reached 210,996, an increase of 72%, ranking it second in both categories. Movistar and Telecom Argentina both announced investments of $2.5bn each in information communications technology (ICT) and infrastructure in the region contributing just over 11% of the total capital invested. In the first half of 2010, 12% of global FDI capital was invested into the Latin America region, with this figure increasing to 20% for the first half of 2011.

Inflows of FDI remained relatively stable across the regions, with some areas experiencing a small increase or decline in project numbers. Jobs created in Africa increased by 58% for the first half of 2011 reflecting an increase of 21% in project numbers.

Western Europe and the Rest of Europe were the only two regions to witness a decline in FDI projects, falling 8% and 2%, respectively. Contributing to this drop was Germany, which witnessed a 50% decrease in FDI projects. However, this decline is not mirrored in capital invested or jobs created where the country achieved small growth.

BRICs on the rise

The US has maintained its ranking as the most popular destination country for global FDI in the first half of 2011, with project numbers rising 9% to 753. However, both capital investment and job creation dropped significantly, with $7bn less invested and 25% fewer jobs created.

The rising stars in the FDI destination table are Brazil and India, which both achieved growth in project numbers, capital investment and job creation. Brazil attracted 62% more FDI projects in the first half of 2011 than in 2010, with capital up 134% to $38bn. There was also a 71% increase in job creation, with nearly 98,000 jobs created in the country.

India also experienced growth across all indicators as a destination for FDI. The country attracted $38bn in capital investment, and both job creation and project numbers also increased by 27% and 26%, respectively.

China and Russia, which partner with Brazil and India to form the BRIC countries, also performed very well. China maintained its top five ranking as a destination across all indicators and achieved a small growth in project numbers and capital investment, losing only 2% in job creation on the first half of 2011. The four BRIC countries all appeared in the top five countries for job creation. They generated an aggregate of nearly 430,000 jobs; 37% of jobs created globally.

Germany was the fifth most popular destination for FDI in the first half of 2010. However, in the first six months of 2011, the country has dropped to sixth place to be replaced by Brazil. Another winner in 2011, is Indonesia, which has attracted capital investment of $15bn in the first half of the year, which is an increase of 435% on 2010. This jump can be accredited to some major investments, including Cyprus-based Solway Group’s $3bn nickel smelting plant in the Maluku Islands, and China Gezhouba Group’s $1bn hydroelectric plant.

Targeting new cities

The top five most popular destination cities for FDI have remained the same as in 2010. Singapore attracted the highest number of projects of all cities, as well as the most capital. Of the $410bn invested globally in the first half of 2011, $8bn was destined for Singapore. Within the top five, Dubai achieved the largest growth on 2010 with 29% more projects.

Capital invested in FDI was targeted at Singapore, London and Chennai, with two new cities entering in the top five: Barcarena in Brazil and Rizhao in China, which attracted $5.7bn and $4.6bn, respectively. This jump in figures can be attributed to some landmark projects, namely Indonesia-based Asia Pacific Resources International’s $4.6bn pulp mill in China and Mir Steel UK’s $5bn steel joint venture with Usipar in Brazil.

The top city for job creation was Chennai, where 19,712 jobs were created by FDI. This figure represents a 189% increase for the city compared with the first-half 2010 figures. Chongqing in China also experienced growth on its 2010 figures, with 483% more jobs being created through FDI projects. This increase was bolstered by companies such as the Taiwan-based Foxconn, which has embarked on significant expansion projects in the city.

Sector Analysis

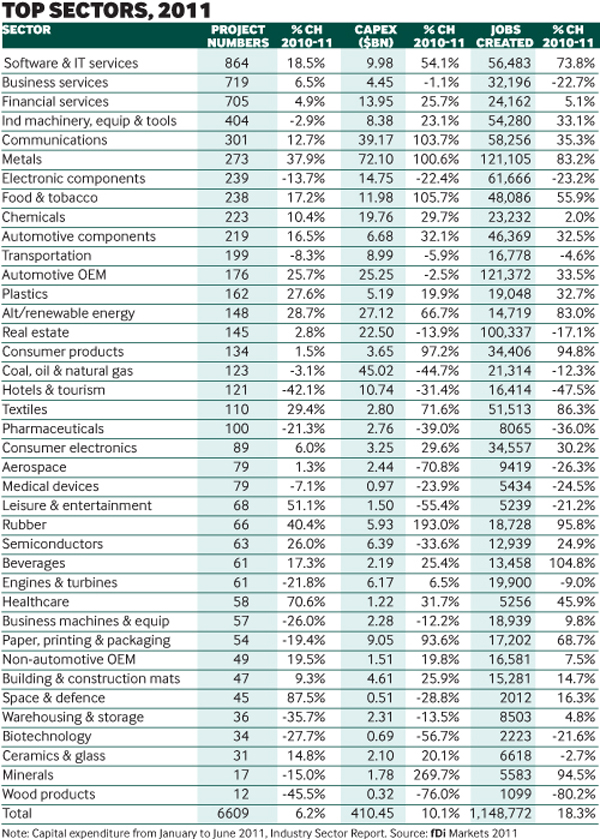

Holding strong

Software and IT, business services and financial services are still the top three sectors for global FDI projects in the first half of 2011. In the first half of 2011, software and IT services has achieved 18% growth, widening the gap between it and business services in second place. Financial services was the leading sector in both 2008 and 2009, but has dropped to third place with 705 projects in 2011 to business services' 719, which accounted for 13% of global FDI. The top five sectors in the first half of 2011 are the same as in 2010, and all except industrial machinery have achieved growth.

Software and IT services experienced significant growth across all indicators, including a 54% increase in capital expenditure. Job creation in the software sector also increased by 74% with more than 56,000 jobs created in 2011 so far compared with 72,000 over the whole of 2010. Both job creation and capital investment decreased in the software sector in 2010.

Business services has remained the second most popular sector for FDI in the first half of 2011 and achieved a 7% growth in project numbers to represent 11% of global FDI. Despite this increase in project numbers, the number of jobs created decreased, with 23% fewer than in the same period in 2010. Capital investment in the business services sector remained stable, with 1% growth.

On the rebound

While financial services has failed to regain the top sectoral ranking it had in 2009, it has rebounded well from 2010 when it experienced a drop across project numbers, capital investment and jobs created, by achieving a 5% increase in project numbers and job creation. In the first six months of this year, financial services has created 24,100 jobs and nearly attracted $14bn in capital investment.

The top five sectors for project numbers also included the industrial machinery equipment and tools sector as well as communications, which, when combined with the top three sectors, account for 45% of global FDI.

Galvanising further growth

The metals sector experienced significant growth in the first half of 2011 with a 38% increase in project numbers. Metals was the ninth most popular sector in terms of project numbers for the whole of 2010 but has risen to sixth in first-half 2011. In 2009, the metals sector did not even feature in the top 10. Capital investment in the sector is up 100% to $72bn and job creation is at 121,000 globally in the first half of 2011. Job creation in the metals sector represents 11% of total global job creation in the first six months of 2011.

The rubber sector experienced an increase in capital of 193% from $2bn in the first half of 2010. Conversely, project numbers in the hotels and tourism sector dropped by 42% to 121 in the first half of 2011. Capital investment and job creation also dropped 31% and 48%, respectively, with the sector creating nearly 15,000 fewer jobs than it did in the same period in 2010.

Business Activity Analysis

Manufacturing a recovery

The top three activities for the first half of 2011, namely manufacturing; sales, market and support; and business services, accounted for almost three quarters (73%) of global FDI. Manufacturing remains the lead business activity, accounting for 27% of global FDI projects, a rise of 19%. An estimated $212.46bn was invested in manufacturing projects in the first half of 2011, which created 689,354 jobs, an increase of 31%. Full-year figures in 2009 showed manufacturing was declining; however, it picked up again in 2010, topping the table. This growth story is continuing in the first six months of 2011, with the trend showing no signs of stopping.

Electricity had fallen between 2009 and 2010. However, in the first half of 2011 project numbers are up by 28%. This is partly due to the rise of alternative/renewable energy. Also on the increase is the number of jobs created by the activity, with figures increasing by 33%.

Construction continues to fall

Construction as a business activity experienced one the greatest declines in the first six months of 2011, with project numbers falling 34%. Capital invested in this activity and jobs created also declined. Conversely, ICT and infrastructure is continuing its successful growth spurt with capital invested up 103% to $37.33bn and jobs rising by 85%. US-based data centre services provider Equinix invested highly in this business activity, setting up data centres globally in 2011.

Fewer companies invested in pure R&D activities, as represented by its 28% decline in the first half of this year. Design, development and testing (DDT) is, however, on the up with project numbers increasing to 343 (an increase of 18%). Capital invested in DDT has also risen by 32%, while its rise in job creation sees the business activity now account for 5% globally.