When measured by the value of investment projects announced in 2017, Poland is ranked as the third highest destination in Europe, following the UK and Russia, according to a report by fDi Intelligence.

Last year’s inflow of greenfield FDI to Poland of $14.8bn means that 2017 was the best year of the past decade. At the same time, positive news regarding the European economy gives reason to believe that 2018 may prove to be as strong as 2017.

Advertisement

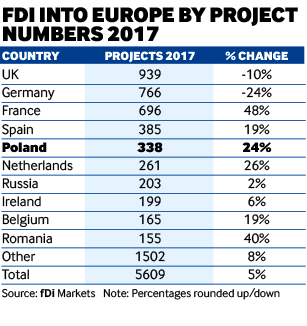

“Europe is heating up. And Poland, with its central location, is an attractive destination for new projects, especially because of Brexit,” says Kiejstut Żagun, director and head of the concessions and subsidies unit at KPMG. And while in 2017 the UK was still a European leader for greenfield capital inflows ($33.2bn), the total value of its investments was 5% lower than in 2016 (only Turkey recorded a deeper fall in investment, by 12%), while the number of new projects dropped by one-tenth.

Concerning FDI project growth, Poland was outdistanced by such countries as the Netherlands and Romania, but total investment in these two countries was visibly lower. “Poland has continued to rise as a key destination for FDI,” states The fDi Report 2018, which contains the investment inflow data.

Automotive magnet

The highest amount of greenfield investment in Poland announced in 2017 was in the construction, ICT and automotive sectors. Transport and business services also proved to be magnets – projects from these sectors dominated in potential new projects currently being implemented by the Polish Investment and Trade Agency (PAIH).

The most significant volume of future investment is likely to come from the US – 59 projects under negotiation with PAIH are jointly worth almost $1.1bn – while Germany and Japan are likely to come in at second and third place.

According to The fDi Report, the US is not only one of the most important global sources of investment, but also the top global destination for it. In 2017, the US dethroned India by accepting a record number of 1627 projects valued at $87.4bn. The $10bn-worth of projects announced by Foxconn (LCD panels manufacturing in Racine, Wisconsin) and Saudi Basic Industries (petrochemical plant in Portland) took the lion’s share of this outlay.

Advertisement

Western Europe turned out to be the most significant global investment source, at 6270 projects, with the total value of $237.8bn from the region or 47.5% of all FDI in the world. The most prominent number of projects (1353) originated in Germany, and they also had the highest total value ($53.9bn). Russia, with FDI valued at $37.4bn, was the second highest European source of this type of investment and, compared with 2016, was up six places.

Asia gets weaker

While reported investments in Europe kept growing, they weakened significantly in the Asia-Pacific region. In China, which amounts to one-quarter of total FDI in the region, their value (as compared with 2016) shrank by 14%, to $50.8bn. The situation was even worse in India and Vietnam, where investment spending fell by 59% and 45%, to $25.1bn and $20.3bn, respectively.

Significant decreases were also recorded in Australia (23%), Indonesia (58%), Malaysia (70%) and Japan (27%). In total, the FDI inflow to the region fell by 44% in 2017, to $196.6bn.

Africa and the Middle East also fell from investors’ graces: FDI in Africa shrank by one-fifth, to $114.6bn. One-third of that amount was taken by Egypt, a host of projects valued at $35.6bn. Drops of more than 40% were recorded for Saudi Arabia, South Africa and Morocco, while investment growth was recorded for Israel, among others.

In Latin America, Mexico was the most attractive destination. In 2017, the country attracted $26.4bn-worth of projects, up by 0.1% on the year before. Brazil came second, with projects valued at $10.3bn, which is 15% less than in the previous year.

Rising costs

In Poland, despite the growth in new investment, rising labour costs are beginning to cause headaches for foreign companies. “The growth in wages is becoming a barrier for investors,” says Paweł Borys, head of the Polish Development Fund, during the April presentation on research findings from 14 bilateral chambers of commerce of 300 foreign companies operating in Poland. The research shows that in 2018, labour costs got lower marks than in 2017, with only 2.99 out of 5 points (down from 3.12 the previous year).

According to Tomasz Pisula, head of PAIH, Poland has stopped being a country that attracts foreign investment mainly for its cheap labour costs. “We are a part of the developed countries. It’s obvious that new investment is more and more often based on higher value added,” says Mr Pisula. And this is precisely the type of investment the state intends to support: parliament is finalising a law that would extend tax relief that is currently limited to the special economic zones to the rest of the country.

Regarding Poland’s FDI results, Paweł Tynel, partner and head of the concessions and subsidies unit at EY, says: “The excellent economic results of the eurozone, as well as the high absorption of manufacturing capacities in many companies, force them to look for new destinations to locate their plants. It turns out that there is still a long time before automation will replace human labour; thus more traditional locations, such as Poland, are still fashionable.

“Regarding ensuring the safety of manufacturing and the quality of work, Poland has been getting very high marks for years. But it’s not only Poland that benefits from such a situation – it’s beneficial for the whole of central and eastern Europe.”

Article originally published by Rzeczpospolita, in co-operation with fDi Magazine.