The Covid-19 crisis may have ravaged many industries, but digital healthcare is among a clutch of tech-led sectors that have thrived during the pandemic as lockdowns force patients to seek non-urgent medical advice online.

Startups that use technology to provide healthcare solutions – known as healthtechs – have sought to capitalise on the surge in demand by aggressively raising capital despite the tight market conditions.

Advertisement

In April, healthtechs raised $1.2bn in venture capital funding, a 9.7% increase on the same month a year earlier, according to PitchBook data. During the same month, venture capital investment across all verticals shrank to $18.4bn, down from $23.8bn a year earlier.

This new investment has enabled healthtech startups to ramp up international expansion plans. US-based health test kit producer LetsGetChecked, for example, raised $71m of funding in early May to scale up production and support staff across Europe and the US.

UK-based digital care startup CeraCare, meanwhile, closed $70m funding round in February and is expanding its headcount and targeting international expansion.

“Startups with the appropriate infrastructure are able to adapt much more quickly to the challenges and crises such as those posed by Covid-19,” said Ben Maruthappu, CEO, CeraCare, adding that the company had seen a surge in job applications from furloughed staff during the crisis and was seeking M&A opportunities in the UK and elsewhere.

Bolstered by new funds, many healtechs are actively seeking acquisitions in an otherwise moribund market.

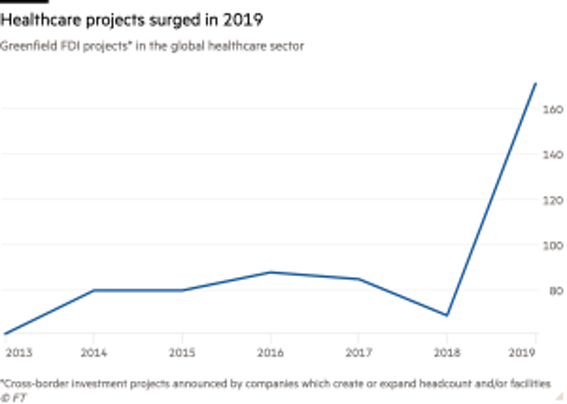

This year, 19 companies in the healthcare sector – including LetsGetChecked and CeraCare – have set aside new funding that could be used for international expansion, according to greenfield investment monitor fDi Markets. The industry as a whole is flourishing. Last year, a record 171 greenfield FDI projects were announced or launched in the global healthcare sector.

Advertisement

The rise of healthtech

The onset of Covid-19 has accelerated the trend towards the digitisation of healthcare services.

"The seamless experience offered by the likes of Amazon, Netflix and Zoom has led consumers to expect the same thing from healthcare services," said Devika Thapar, partner at Wilbe Ventures, a VC firm which helps scientists commercialise their research.

“The rising convergence of digital, health and even biotech has set a precedent for the future of healthcare and the pandemic has accelerated these previously slow moving trends.”

Telemedicine providers that enable remote diagnosis and treatment of patients via digital platforms have successfully raised capital this year.

Swedish telemedicine provider Kry raised €140m in January to support expansion in Europe and in April launched a video consultation platform in the US.

Another telemedicine provider UK-based Babylon Health raised a whopping $550m in August last year and has been expanding internationally. It has operations in Canada and Rwanda and has moved into the US market during the coronavirus outbreak.

Stockholm-based Doctrin – a platform that enables healthcare providers to treat patients online – has also seen a surge in demand and usage during the crisis. Doctrin co-founder Magnus Liungman said the company had been able to expand at a “much higher rate” than before the Covid-19 outbeak and is establishing an office in the UK.

Regulatory obstacles

There are, however, regulatory hurdles that could slow the pace at which the healthtech sector develops. In certain jurisdictions, even a well financed startup can struggle to gain permission to operate or face significant obstacles to doing business.

“The healthtech market is unique and challenging because of the regulated nature [of the healthcare sector],” said Nick Stock, general partner at White Star Capital, an early stage venture capital fund that invests in startups with global ambitions.

Agate Freimane, investment director at Sweden-based Norrsken Foundation, a VC fund which invests in impact-driven tech startups, remains optimistic. “The momentum around digital healthcare has been building for some time and reached new heights when Germany announced the Digital Healthcare Act,” she said.

Germany passed the Digital Healthcare Act in November last year. It allowed digital health applications to be reimbursed by statutory health insurance funds, opening up Europe’s largest economy – which has 73 million people using state health insurance schemes – to healthtech operations.

“Other countries are expected to follow [Germany’s lead] and digital healthcare startups are accelerating their business plans,” Ms Freimane added.

On top of regulatory obstacles, the current under-pressure market environment may present additional challenges. “Tougher FDI screenings may cause additional uncertainties when it comes to formalising a decision to invest,” said Paulette Vander Schueren, a partner at law firm Mayer Brown, warning that smaller startups may need to consider how a more protectionist business climate might impact their business models and ability to raise capital.