Togo’s strong performance in 2019 gained the west African country the crown as the world’s best performing country relative to its size when it comes to attracting FDI.

Download a PDF of this ranking here:

Advertisement

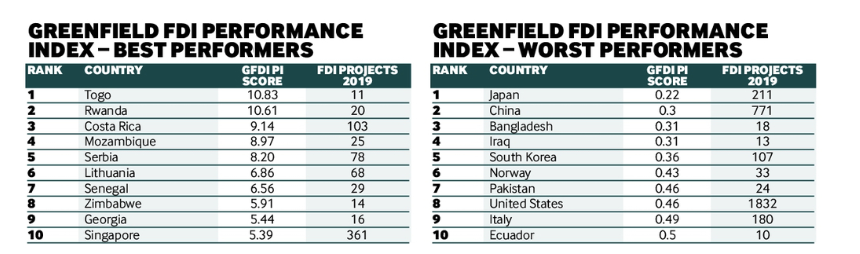

Togo topped the annual reading of the Greenfield Performance Index as a new entrant (only countries that attract 10 or more FDI projects make the ranking) with a score of 10.8. It is closely followed by Rwanda (10.6) and Costa Rica (9.1) in second and third place respectively.

Last year’s number one, Serbia, fell to fifth place after the number of inward FDI projects it received dropped by more than a third: 78 in 2019, compared to 105 in 2018.

Of the 101 locations analysed in the 2020 Greenfield Performance Index, 75 had an index score greater than 1, while 26 had a score of 1 or less. A score of 1 indicates a country’s share of global inward greenfield FDI matches its relative share of global GDP, a score greater than 1 indicates a larger share than indicated by its GDP and a score of less than 1 indicates a smaller share. Togo is thus attracting more than 10 times the amount of greenfield FDI that might be expected given the size of its economy.

At the other end of the spectrum, Japan and China scored 0.22 and 0.30 respectively. They stand out as the lowest performing countries given the size of their economies, and also for their typical hard and soft barriers to foreign investment. Bangladesh (0.31), Iraq (0.31) and South Korea (0.36) are also attracting much less FDI in proportion to the size of their economies.

Togo, one of the smallest countries in Africa, attracted 11 FDI projects in 2019 – its best performance since fDi Markets began recording data in 2003. Financial services, building materials and business services are the country’s leading FDI sectors and accounted for almost half (46.2%) of its inward FDI projects in 2019. In November 2019, Nigeria-based Dangote Group, the biggest conglomerate in west Africa, announced plans to establish a new $2bn phosphate fertiliser processing facility in Togo. This will involve the creation of 2500 jobs.

Advertisement

Rwanda is another new entrant to this year’s index. The east African country recorded 20 FDI projects in 2019, its peak year since 2009. Business services was the country’s leading FDI sector in 2019, representing 35% of total inward FDI.

Costa Rica jumped from 13th in the previous study to third in the 2020 index, improving its score by 4.36 points. The country experienced modest gross domestic product (GDP) growth from 2018 to 2019 (+0.92%), but almost doubled its inward FDI projects. Its jump from 53 in 2018 to 103 in 2019 is the largest score of any country globally, receiving more than 100 projects.

Of the world’s 10 largest economies, five had an index score above 1 – the UK (2.51), France (1.4), Germany (1.3), India (1.21) and Canada (1.08). Five of the top 10 also had a higher score in 2020 index compared to their previous score, including the US, the UK and Canada.

The Greenfield Performance Index uses a methodology devised by Unctad for overall FDI, and applies it to only greenfield FDI – excluding M&A, intracompany loans and other forms of cross-border investment.

Regional Analysis

Africa

Nineteen of the 21 African countries that made it into the index had a score of more than 1, the two exceptions being Nigeria and Algeria. Last year’s regional winner, Mozambique, improved its score by 3.89 points but was knocked down to third place by new entrants Togo and Rwanda.

Asia-Pacific

Twenty-three Asian countries were included in this year’s index, representing almost a quarter of the total countries analysed. Sixteen Asia-Pacific countries achieved a score greater than 1. Georgia is the leading Asian country, and ranks ninth overall, with a score of 5.44. Singapore climbs from fourth to second in the regional ranking and Vietnam maintains third place from the previous study.

Emerging Europe

Fourteen of the 16 emerging European countries analysed recorded a score greater than 1, with only Belarus (0.95) and Russia (0.81) falling slightly below the proportional benchmark. Last year’s overall winner, Serbia, maintained its regional crown, despite dropping to fifth in the global ranking.

Latin America & Caribbean

Costa Rica is the runaway regional winner, improving its score by 4.36 points compared to the previous year. There is a notable gap between the Central American country and its closest counterparts, with second-placed Colombia scoring 2.81 and third-placed Chile scoring 2.08.

Middle East

Five of the nine Middle Eastern countries analysed had scores above 1. The United Arab Emirates maintains its position as the leading Middle Eastern country with a score of 5.24, followed by Bahrain (3.40) and Oman (3.32) in second and third position respectively.

North America

Both Canada and the US slightly improved their scores in this year’s index. Canada scored 1.08 in the 2020 study, compared to 1.05 in 2019, while the US scored 0.46, up from 0.42. The US score of below 1 indicates that it is a larger global player with regards to GDP relative to FDI. The number of FDI projects into Canada increased by 5.2% in 2019 and into the US by 14.8%.

Western Europe

Malta tops the western European regional index, followed by Finland and Portugal in second and third place. Almost a quarter (23.1%) of all greenfield FDI projects into Malta in 2019 were in financial services. Ireland, last year’s regional winner, fell to fourth place.

Greenfield FDI data used in the index is derived from fDi Markets, and excludes retail investments.

The 2020 index had 101 countries, four less than in the previous index. Angola, Cameroon, Iraq, Namibia, Rwanda, Senegal, Togo and Uruguay were new entrants. To be included in the index, a country must have received at least 10 greenfield FDI projects in 2019. The 2018 FDI figures were revised from last year’s index as further project information became available in 2019/20. GDP figures were also revised on more recent data from the IMF (from the fourth quarter of 2019).

This article first appeared in the August - September edition of fDi Magazine.