Countries may achieve their economic development with full and equal participation of women and men. The International Monetary Fund has shown that gender equality is associated with economic development. Narrowing the gender gap in employment, wages, health and education may reduce poverty and generate sustainable economic growth, as noted by the Organisation for Economic Co-operation and Development in 2012.

To that end, foreign direct investment (FDI) brings the potential to promote greater gender equity through increased and new employment opportunities for women. But FDI can also worsen gender inequality, depending on the type of technology it brings, the predominant occupations of women, firms’ export activities, the competitive environment and the origin of the investment.

Advertisement

Bangladeshi practices

In our study, we have looked at the female employment practices of FDI firms in Bangladesh’s apparel and textiles sector, and their domestic suppliers and customers. Traditionally, in the study of FDI spillovers, the focus is on the impact of FDI presence on the productivity of domestic firms. We examined how FDI affects female employment directly — especially via supply chain linkages — and found that in this particular case, not only did FDI firms hire more women, but that these practices had positive ripple effects up and down supply chain linkages. The study did not collect information on wages by gender.

The unique survey dataset used in the study includes novel and rarely available information capturing firms’ suppliers and customers. Studies of supply chain linkages and gender impacts are rare, owing to the difficulties in measuring such linkages. While it covers only one year, 2005, it shows robust correlations, and provides historic perspective on an earlier stage of the development of apparel and textiles sectors in Bangladesh.

The ready-made garments sector in Bangladesh has been a key contributor to the country's robust economic growth, poverty reduction and women's empowerment over the past three decades. Bangladesh is the world’s second largest exporter of ready-made garments after China; the sector accounted for more than 80% of the country's exports as of 2015 and provided jobs to more than 4 million low- and semi-skilled workers.

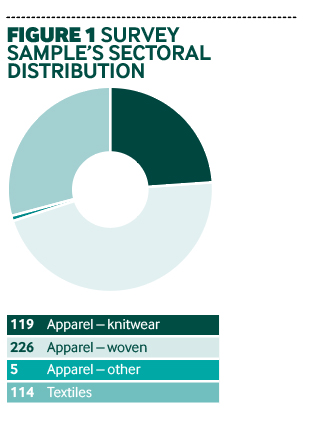

The unique firm-level survey collected by the World Bank covers representative samples of firms in apparel and in textiles sectors, and includes information on each firm’s suppliers and customers, which allows the construction of novel measures of supply chain linkages to FDI firms in the country (see Figure 1). The study follows the approach proposed by Kee in 2015, by relating FDI firms with domestic firms that share their local input suppliers, that are designated as FDI siblings, while domestic firms that share their local customers with FDI firms are referred to as FDI partners.

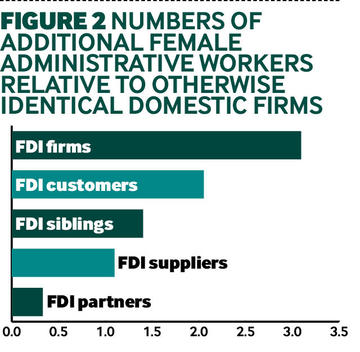

As a first step, the study looks for differences in terms of female hiring practices of FDI firms relative to domestic firms in Bangladesh. FDI firms are shown to employ significantly more female administrative workers and non-administrative (production) workers than domestic firms. This is true even when comparing firms of similar sizes in similar locations and engaged in similar sub-industry activities. On average, FDI firms hire three more female administrative workers than domestic firms that are of the same size, location and industry (see Figure 1).

Advertisement

Then, the study examines the unique firm-to-firm relationships in their dataset to assess whether domestic firms that are related to FDI firms as their suppliers or their customers are different from other domestic firms in terms of gender employment practices. Customers of FDI firms are found to hire significantly more female administrative workers, while suppliers of FDI firms do not exhibit different gender employment practices (see Figure 2).

Finally, the study explores the female hiring practices of domestic firms that share local suppliers or local customers with FDI firms (designated as FDI siblings or FDI partners). Apparel firms that are FDI siblings employ significantly more female administrative workers than other domestic firms, but FDI partners do not seem to be different (see Figure 2).

While it might seem evident that FDI would lead to more job opportunities or better pay for women, that is not always the case. Foreign-owned companies may need skilled workers to operate their production processes, which may disadvantage women in countries where there is an educational gender gap. Foreign-owned firms that use automated processes may lower employment opportunities and wages for women engaged in manual occupations. FDI could potentially depress wages for women if family responsibilities make them less flexible in their work hours than men. In addition, women’s wage bargaining power may be reduced by the introduction of greater competition from foreign firms. Finally, foreign investment may originate in countries biased against female labour.

At the time that the survey was conducted in Bangladesh, the evidence shows that by hiring more female administrative workers, the presence of FDI firms in the textiles and apparel sector appears to have created an environment that encouraged related domestic firms to employ more female administrative workers.

Ana M. Fernandes is a senior economist in the Trade and International Integration unit of the Development Research group at the World Bank.

Hiau Looi Kee is a lead economist with the Trade team of the World Bank Research department.

This article first appeared in the October/November print edition of fDi Intelligence.