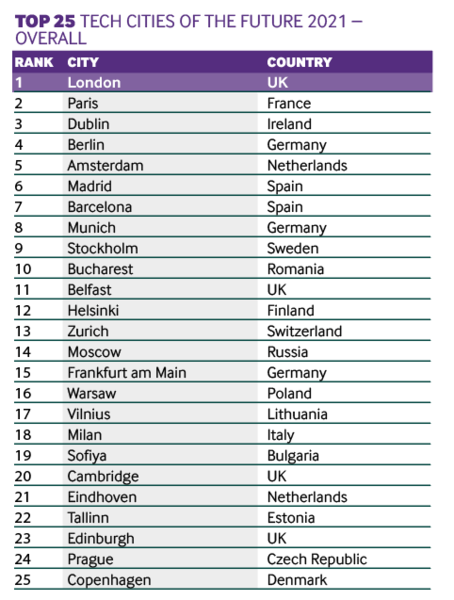

Despite what has been a challenging period for the global economy and foreign direct investment (FDI), London has held onto its crown as the top European city in the fDi and TNW Tech Cities of the Future 2021.

European peers such as Paris and Dublin came in second and third respectively, as was the case in the 2020 iteration of the ranking. Other standout performers such as Berlin, Madrid and Stockholm have jumped multiple positions since the previous study.

Advertisement

The Tech Cities of the Future ranking is focused on finding those European cities with the most promising prospects for start-ups, technology and innovation investment.

For this ranking, data was collected, analysed and ranked for 76 cities across 31 European countries under five categories: Cost Effectiveness, Economic Potential, FDI Performance, Innovation & Attractiveness and Start-Up Environment.

Download a PDF of these rankings here: fDi x TNW Tech Cities of the Future 2021

Holding strong

London for the second year triumphed in the ranking, placing first in five out of the six categories. According to research from greenfield investment monitor fDi Markets, London remained the top global city for FDI projects in 2020, attracting 366 projects during the year.

In a record-setting year for venture capital funding, according to Dealroom.com, London tech firms raised $10.5bn in 2020, which accounted for a quarter of all European tech funding for the year. Beneficiaries include Revolut, Monzo, Arrival and Deliveroo. The latter also chose London for its initial public offering in March 2021.

Advertisement

The UK capital continues to be a world-class hub for innovation, taking first place in the Innovation & Attractiveness category. Within this category, according to data from the US Patent and Trademark Office, London shone with nearly 7000 patents in software and more than 150 in artificial intelligence registered in the city between 2003 and 2020, more than any other city in the ranking.

Moreover, the UK capital also hosts more than 370,000 students and seven of the top 500 universities in computer science and engineering, according to the QS World University Rankings, highlighting London’s attractiveness as a city for skilled talent.

As a global financial centre, London offers start-ups a host of financing options, ranging from venture capital funds and angel investors to crowdfunding platforms and banks.

London reflected this with a remarkable performance in the Start-up Environment category. Figures from Dun & Bradstreet show the city boasts more than 80,000 companies in software and IT services, nearly double the number of companies found in any other European location in the ranking.

R&D Hub (Paris)

Paris ranked second overall in fDi x TNW Tech Cities of the Future 2021 ranking. Once again, the French capital demonstrated a strong performance across multiple categories. Paris fared particularly well in the FDI Performance category. According to fDi Markets data, the city attracted 495 projects in the software and IT services sector between January 2016 and December 2020, second only to London in Europe in the period.

These projects included the likes of Ericsson, which opened its first R&D centre in the Paris region, with the aims of accelerating 5G dynamics within Europe, and Dell Technologies, which expanded its R&D operations into the French capital, creating 60 jobs in the process.

Paris also excelled in the Innovation & Attractiveness category. According to the QS World University Rankings, the French capital hosts four of the top 500 universities in electrical and electronic engineering and five universities in the top 500 universities for computer science and engineering.

The World Bank Doing Business Report states that France provides minimal start-up obstacles, with only four days required to start a business. Along with the multitude of incentives and support schemes in place to assist businesses, Paris remains a desirable proposition for European entrepreneurs and tech start-ups.

Continued Potential and Performance (Dublin)

Dublin places third in the study for a second consecutive year. The Irish capital ranked third in the Economic Potential category, with Ireland excelling in various country-level data points, including the 2021 Index of Economic Freedom.

Dublin’s strengths were also seen in the FDI Performance category, with more than 6500 outward FDI jobs created by start-up companies between 2016 and 2020, which was second highest of all European cities ranked after London.

Dublin continues to be a thriving hotspot in the start-up space, thanks in part to Enterprise Ireland, which doubled the funding provided against 2019, investing $56.5m in 2020 across 125 new start-ups.

Furthermore, larger companies have also announced FDI projects into the Irish capital. These include Mastercard, which launched a new campus in Dublin, creating 1500 jobs, and Microsoft, which announced plans to create a $31m engineering hub in the Irish capital, creating 200 jobs.

Spotlight on…

Stockholm

Stockholm placed ninth, up three places from last year’s ranking, after performing exceptionally well in the Innovation & Attractiveness and Start-Up Environment categories. The Swedish capital has developed a flourishing fintech ecosystem around homegrown sensation Klarna. It also benefitted from a series of country-level data points. Sweden ranked second in the World Intellectual Property Organisation’s 2020 Global Innovation Index and was ranked the top European country in Huawei’s Global Connectivity Index.

Madrid

Madrid achieved sixth place, up five positions on the previous year’s ranking. The Spanish capital continued to excel in the FDI Performance category and performed well in the Start-Up Environment category, as home to more than 300 start-ups and 100 co-working spaces. Furthermore, according to data published by Dun & Bradstreet, Madrid has the second-highest number of companies in communications from all the cities within the ranking.

Berlin

The German capital ranked fourth overall, moving up one place on the previous year, thanks to a strong performance in the Start-Up Environment category. Due in part to long-standing partnerships and support from private and public organisations in the city, Berlin received more than $900m in venture capital funding in 2020, according to Pitchbook, second only to London for the year.

Methodology

To create a shortlist for fDi x TNW Tech Cities of the Future 2021, the fDi Intelligence division of the Financial Times collected data using the specialist online FDI tools fDi Benchmark and fDi Markets, as well as other sources.

Data was collected for 76 locations across Europe, under five categories: Economic Potential, Innovation & Attractiveness, FDI Performance, Cost Effectiveness and Start-up Environment.

Locations scored up to a maximum of 10 points for each data point, weighted by importance to the FDI decision-making process to compile the subcategory rankings. In addition, surveys were collected under a sixth category, FDI Strategy, for which there were 32 submissions.

Locations that ranked in the top 20 in this category were given bonus points, contributing to their overall score. Together, the data subcategory rankings and the FDI Strategy ranking make up the overall fDi and TNW Tech Cities of the Future 2021 ranking.

This article first appeared in the August/September print edition of fDi Intelligence.