Investors are prioritising innovation and research and development (R&D) capabilities in their decision-making, as Covid-19 sharpens their focus on high value-added investments, a recent survey of 500 business leaders has found.

The results of Kearney’s latest Foreign Direct Investment (FDI) Confidence Index suggest advanced economies, with their relatively mature tech ecosystems, have an edge in the intensifying competition for FDI flows which have been slashed by the pandemic.

Advertisement

The 2021 ranking of countries likely to attract the most FDI over the next three years continues to be dominated by developed markets, which take 22 of the top 25 spots for the third year running. The US continues its nine-year stint in pole position, followed by Canada, Germany and the UK.

Investment potential

Speaking at the report’s launch, co-author and Kearney partner Erik Peterson said the results are driven not only by investors’ preference for safety and stability, but also their desire to “assign priority to destinations with strong infrastructure and investment in tech and innovation.”

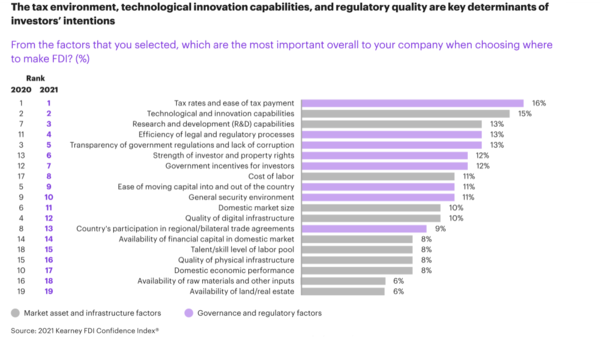

This is reflected by the shift in what is considered the most important host-country criteria, with R&D capabilities jumping from seventh to third place. Tech and innovation capabilities holds onto second-place, beaten only marginally by tax considerations, while the quality of local talent moves up three places to 15th.

Kearney forecasts a long-haul recovery for global FDI, with 2016’s $2tn levels not expected until 2028 at the earliest. But senior partner Ettore Pastore expects no slowdown in automation, IT, digitisation or artificial intelligence investments for the foreseeable future.

“It is obvious that in recent years, FDI occurs only when there is a very high [component] of innovation. And this, of course, is logically correlated to developed markets,” he said.

Advertisement

The pandemic’s acceleration of technology and geopolitical tensions, which has created trade friction and supply chain risks, is radically changing the global investment calculus, according to Kearney’s Paul Laudicina, who founded the index 23 years ago.

“The world is in the midst of a dramatic rethink of FDI as corporate investors reflect on where they need to be and with what kind of resources,” he said. “Frankly, it’s not since the late 1990s that we have seen such a fundamental global strategic recalibration by businesses.”

Survey respondents express a greater willingness to maintain or expand investments in advanced economies compared to their less-advanced peers.

“Our findings suggest that when FDI flows do rebound, developed markets will have an edge in securing a higher percentage of these investments,” the report reads. This is bad news for developing nations whose economic recoveries are already crippled by vaccine shortages and governments’ inability to launch sizeable stimulus programmes.

Data is king

In line with the shift towards a digital economy, respondents highlight the critical role of data in daily operations and how the proliferation of data regulations affects their FDI decisions. Around 80% say local storage and processing requirements, along with restrictions on data transfers, has a moderate-to-significant impact on their existing foreign investments.

“I see companies continuously re-evaluating their investments and being on the outlook for opportunities,” said Kearney partner Daniela Chikova. “In that evaluation, the cost of data regulation plays a significant role.” More than 70% of respondents are also concerned about data nationalism.

Reflecting on the economy as a whole, only 57% of respondents are optimistic about the next three years, down from 72% in early 2020. But the silver lining is that 81% still believe FDI will continue to drive corporate profitability and competitiveness. “Despite the economic and financial shockwaves of the pandemic, investors remain convinced of the benefits of FDI,” the report states.