In the past 10 years, the shared service centre (SSC) concept has emerged as the dominant business trend for the provision of cost-effective support functions. Today, 80% of all Fortune 500 companies have implemented SSCs.

The model spread to Europe in the mid-1990s, led by US conglomerates that had introduced and proven the concept in their home market. Despite its demographic similarities to the US, Europe posed additional challenges to the exponents of shared services: cross-border trading, multiple languages, cultural diversity and incompatible infrastructures. The model today is still mainly a Western phenomenon, with Asian multinational companies not yet adopting the model as a business practice.

Advertisement

The key drivers were economies of scale, leverage of scarce resources, optimisation of technology and creation of better information. Many corporations now use shared services as a tool to create global/European businesses with a sales focus in each country, optimised supply chain and support processes consolidated into a SSC.

Enterprises find that SSCs help them to establish stricter business discipline, tighter control, higher visibility of information and improved service culture. However, scale is the key parameter because the benefits of such investment can only be recouped if the company has the scale and diversity of international operations.

The major business processes that lend themselves to SSCs are finance, procurement, human resources, customer relationship management and call centres, IT hardware and maintenance support, and IT applications development, implementation and support.

In terms of industry sectors, SSCs have had greatest penetration in pharmaceuticals, IT, transport, financial services, oil and gas and consumer packaged goods.

European landscape

The development of SSCs in Europe can be misleading if viewed only from their current distribution across the markets. This view reflects almost 10 years of evolution. As companies have become accustomed to setting up and running SSCs, their knowledge of the benefits that can be gained and the requirements of a location for setting up a centre has led to new locations being used for such facilities. This process will continue to evolve as the functions carried out in each centre are refined and new, more diverse, geographic locations are considered suitable.

The various waves of SSC development have opened up new locations as centres for these facilities (see table below). As can be seen, this trend is moving progressively east.

Advertisement

Overall, there is no specific type of industry, other than business services, that is likely to use an SSC. The main criteria are company size and the number of facilities and operations it has across Europe. The larger the operations and number of facilities, the greater the benefits accrued from a SSC.

Key markets

In Europe, almost 70% of pan-European SSCs are based in four key markets. In order of importance, these are: the UK, Ireland, Netherlands and Spain. However, recent Oxford Intelligence interviews with companies operating an SSC or planning to operate one indicate that the future locations being considered are very different and more closely reflect the third wave of SSC investors.

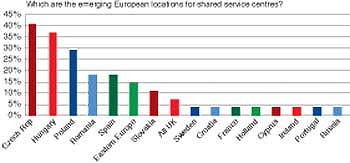

Perceptions are overwhelmingly focused on eastern and central European locations. The concept of shifting territories – the ebb and flow of companies seeking lower-cost destinations while maintaining consistent skills levels (not to mention infrastructure, accessibility as well as a pleasing living environment) – seems to be generally accepted by company managers. The “most attractive destination” has become a moving target, with countries in eastern Europe – particularly the Czech Republic at 40.7%, Hungary at 37% and Poland at 29.6% (see graph 1) – seen as the most popular emerging onshore destinations.

GRAPH 1: LOCATIONS FOR SHARED SERVICE CENTRES

Source: Oxford Intelligence

New locations

Companies in the market for new SSC locations are well aware that today’s emerging player is tomorrow’s saturated destination, each area benefiting in turn from the increased employment and improved infrastructure that this transient popularity brings. To quote one wise and wary company manager: “Things change, and companies have to be aware of exactly how long they can reap the benefits of a particular location (such as labour costs, tax benefits etc) before they move on.”

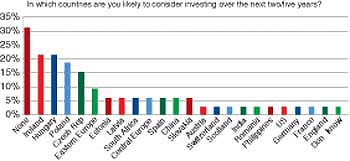

This viewpoint is clearly reflected in company plans for the next two to five years. Oxford Intelligence’s survey results (see graph 2) show that the Republic of Ireland is still a key investment location, with a tax-driven support strategy, as are the markets in central Europe, where lower costs are driving investment decisions.

GRAPH 2: INVESTMENT PLANS

Source: Oxford Intelligence

Future trends

The opportunity for further growth in shared service facilities is strong. This phenomenon has been the domain of global 500 companies. However, as familiarity and experience with the process becomes more widespread, these types of facilities will become the norm for global 1000 companies and beyond.

For existing investors, there is still a clear opportunity for further expansion of the SSC process. The majority of SSCs service the financial areas of a company. However the SSC template is being extended to human resources, sales support, research and development, and the supply chain.

Further experience of running a SSC also empowers companies to examine the entire process that passes through the centre. This is leading to greater rationalisation of processes and refinement of centres. SSCs in high-cost locations, such as London and Amsterdam, will focus on highly technical and high-value expertise, while other processes will be further off-shored, not just to central Europe, but also further afield to India, South Africa and beyond.

The expansion of the SSC phenomenon into medium-sized organisations will begin when standalone business processing organisations come into existence. These will be companies that have been spun out of global 500 organisations which specialise in delivering a SSC solution as part of an outsourced process. Companies will specialise in running the shared service process and will act as an outsourced solution to multinationals and medium-sized enterprises. At this point, the two phenomena – outsourcing and offshoring – will converge to drive down costs and deliver maximum value to the companies.

The winning locations will be those that deliver quality and expertise at the top end of the process, and quality and low cost on more routine processes.

In 2004, Oxford Intelligence published ‘SSCs for Europe – Investment Strategies and Location Benchmarking Study’, a report focusing on the future of international investment trends in locations of SSCs serving the European market. The study incorporated an independent benchmarking analysis of key European and offshore locations, with particular emphasis on India, Malaysia and South Africa. The core of the research was a programme of executive depth interviews with a sample of key companies that have invested in European SSCs.

For more information,

e-mail: research@oxint.com or

tel: +44 (0)1908 521477.