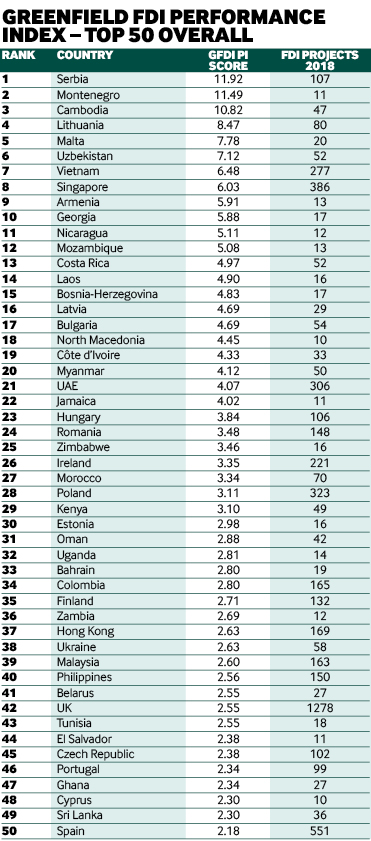

Serbia tops the Greenfield FDI Performance Index 2019. The south-east European country is ranked number one in the annual study by fDi Intelligence, a Financial Times data division of which fDi Magazine is also a part, which looked at inbound greenfield investment in 2018 relative to the size of each country’s economy. Serbia scores 11.92 in the index, closely followed by Montenegro (11.49) in second place and Cambodia (10.82) in third.

Last year’s number one, Mozambique, falls to 12th place after receiving less than half the number of FDI projects in 2018 as it did in 2017. Serbia takes over as the index leader, up one position from the previous year.

Advertisement

Serbia soars

Serbia’s index score has improved by 1.33 index points. Although the country’s GDP growth was high in 2018 (14.8%), it received 107 FDI projects – 26 more than 2017 – growing by almost one-third.

Automotive components, food and tobacco, textiles and real estate are Serbia’s leading FDI sectors, and combined they accounted for more than half (54%) of total inbound FDI projects in 2018.

Montenegro, which borders Serbia to the south-west and is a new entrant to the 2019 index, ranks second. Although relatively low, the country recorded 11 FDI projects in 2018 – its peak year since fDi Markets began recording FDI data in 2003.

Exceeding expectations

Of the 105 locations analysed in the 2019 Greenfield FDI Performance Index, 82 have an index score greater than 1, while 23 have a score of less than 1. A score of 1 indicates a country’s share of global inward greenfield FDI matches its relative share of global GDP. A score greater than 1 indicates a larger share than indicated by its GDP and a score of less than 1 indicates a smaller share.

Advertisement

Serbia, with a score of 11.92, is attracting almost 12 times the amount of greenfield FDI that might be expected given the size of its economy.

Each of the top 10 countries ranked in the 2019 index experienced an increase in FDI project numbers in 2018 compared to 2017.

The index uses a methodology devised by Unctad for overall FDI, and applies it to only greenfield FDI – excluding M&A, intracompany loans and other forms of crossborder investment.

Of the 10 largest economies in the world, five have an index score above 1: the UK (2.55), India (1.54), France (1.26), Canada (1.04) and Germany (1.01). Six of the top 10 had a higher score in 2018 compared to 2017 (including Canada, India and the UK).

Regional analysis

Africa

Fifteen African countries make it into the index, of which only Nigeria and Algeria have a score of less than 1. Despite its slide in the overall index, Mozambique remains the leading African country with an index score of 5.08. Côte d’Ivoire (4.33) and Zimbabwe (3.46) have seen the largest improvements in scores, ranking second and third, respectively.

Asia-Pacific

Accounting for almost one-quarter of all countries listed in the index, Asia-Pacific has 18 countries with a score greater than 1 (and seven with a score of less than 1). Cambodia is the leading Asian country, and ranks third overall, with a score of 10.82. Uzbekistan (7.12), a new entrant, and Vietnam (6.48) rank second and third, respectively, with Singapore slipping two places to fourth. Only Serbia has a higher score than Vietnam and Singapore out of all the countries that received more than 100 inbound projects in 2018.

Emerging Europe

Nineteen of the 20 emerging European countries analysed recorded a score greater than 1. Only Russia, which scores 0.95, fell slightly below the proportional benchmark. Serbia (11.92) and Montenegro (11.49) have far exceeded their regional counterparts, including the likes of Lithuania and Bosnia-Herzegovina, which have high index scores.

Latin America and the Caribbean

Nicaragua remains the region’s index leader despite a drop in score to 5.11 (from 5.43 in 2017). The central American country is now only marginally ahead of Costa Rica (4.97), which ranks second regionally. Jamaica (4.02), a new entrant to the 2018 index, places third. There is a notable gap between the top three index scores and their nearest counterparts, Colombia (2.80), El Salvador (2.38) and Mexico (2.08).

Middle East

Five of the nine Middle Eastern countries analysed have scores above 1. The United Arab Emirates tops the regional index with a score of 4.07, followed by Oman with 2.88. Bahrain, which topped the index last year, places third with a score of 2.80. The UAE has the fourth largest score of any country globally in receipt of more than 100 inbound projects.

North America

Canada has scored 1.04 in this year’s index, up from 0.91 in 2017. The US scores 0.44, indicating that it is a much larger global player in respect of GDP relative to FDI. The number of FDI projects into Canada increased in 2018 by more than one-fifth, while the number into the US declined by 3%.

Western Europe

Malta tops the western European regional index by some margin. The country received a record number of FDI projects (20) in 2018 – double its volume recorded in 2017. Malta’s index score of 7.78 was significantly larger than its regional counterparts. Financial services FDI was the country’s key sector, accounting for almost half (45%) of its total projects.

Ireland (3.35) and Finland (2.71) rank second and third, respectively.

The UK (2.55), Portugal (2.34) and Spain (2.18) are the next highest scorers in western Europe. Luxembourg (2.13), which was regional leader in 2017, falls to seventh place.

Methodology

Greenfield FDI data used in the index is derived from fDi Markets, and excludes retail investments. The 2019 index has 105 countries, 13 more than the previous index. There are 13 new entrants: Bolivia, Cyprus, El Salvador, Guatemala, Jamaica, Kuwait, Laos, North Macedonia, Montenegro, Paraguay, Uganda, Uzbekistan and Zimbabwe. To be included in the index, a country must have received at least 10 greenfield FDI projects in 2018. The 2017 FDI figures were revised from last year’s index as further project information became available in 2018/19. GDP figures were also revised on more recent data from the IMF (from the second quarter of 2019).