Korea has taken on board the views of foreign investors and is striving to make the country more business friendly. According to the latest survey released by Korea Trade and Investment Promotion Agency (Kotra), 76.5% of respondents said they were satisfied with the Korean business environment and 42.6% said they were content with the country’s living conditions. This is a significant improvement from last year’s poll, in which only 26.5% gave a favourable response about life in Korea for foreign executives.

Nearly half of the respondents expect the business environment to improve during the next three years, while 21% are concerned about a possible worsening, with the remainder expecting little if any change in either direction. Most of the improvements cited were in language and communication, a reduction in bureaucratic red tape and greater corporate transparency.

Advertisement

“By identifying what foreign residents feel about Korea, we can uncover practical ways to give them help,” says Chung Tong-soo, head of InvestKorea, Kotra’s investment promotion arm. An example cited was the Investor Express Card, which allows foreign investors in Korea to use separate immigration checkpoints when entering or departing Korea. The card, issued by the ministries of knowledge economy and justice, is available for executives of companies that have invested more than $5m in the Korean manufacturing industry or more than $10m in the domestic tourism industry.

Yet, there are still obstacles to be overcome. Although the executives surveyed said the educational environment was one of the most important issues when considering Korean living standards, only 14.4% expressed satisfaction with this subject. The main reasons for the negative outlook are a lack of foreign language schools in Korea, as well as high tuition fees.

Cultural importance

The cultural factor is hardly a trivial issue for FDI. Ahn Choong-yong, a foreign investment ombudsman at the Kotra and a member of the Presidential Council on National Competitiveness, believes that some Koreans still harbour suspicions regarding the remittance of profit by foreign companies.

“This negative sentiment has been aggravated by occasional criticism from the international press regarding speculative hedge funds,” says Mr Choong-yong. “Unfortunately, this mindset continues even within some government agencies and to a certain extent in the private sector, despite Korea’s outward-oriented economic structure and the government’s renewed emphasis on promoting FDI.”

He adds: “Many foreign CEOs in Korea express dismay at rapidly rising wages, violent labour strikes and the complex web of regulations. Some also believe that Koreans still have a deeply imbued xenophobia. Recently, the fact that many Koreans are nationalistic and anti-foreign came to the fore with the protests against US beef imports.”

An alarming sign in Korea’s inbound FDI is the sizeable deficit in net FDI. For the first time since the Bank of Korea started compiling statistics in 1980, FDI in Korea posted a net outflow in the first half of this year. Korea’s inbound FDI has been gradually declining since the $12.8bn recorded in 2004, after peaking at $15.5bn in 1999. This exacerbates what, according to Organisation for Economic Co-operation and Development (OECD) estimates, is going to be a testing time for the Korean economy, with GDP forecast to decline to 4.3% in 2008 from 5% last year, before rising back up to that level in 2009.

Advertisement

Recovery process

FDI will play a key role in this recovery process, in particular in areas such as the export of goods and services, employment and domestic demand. “Regulatory reform and measures to reverse the declining trend in inflows of FDI are essential to sustain high growth,” says the OECD in its Economic Outlook report for 2008.

The government has designated 2008 as a “take-off period for FDI” and is hoping to attract inward investment of about $12bn. A package of measures has been introduced to achieve this, including the Capital Markets Consolidation Act, a reduction of the corporate tax rate to 20% by 2012 and the provision of incentives for improved labour relations.

Mr Choong-yong maintains that the strategy of relying on domestic brands to compete in the global market is no longer effective, given the widening supply chains and production fragmentation. “To the extent that Korea is able to attract multinational companies to create job opportunities, acquire and implement new technologies as well as innovative ways of doing business in the 21st-century economy, it will enjoy previously untapped sources of economic growth in the years to come,” he says.

Growth-orientated economy

President Lee Myung-bak has recognised this problem and pledged to return Korea to a more growth-oriented economy under his ‘7-4-7’ campaign. Mr Lee created the Presidential Council on National Competitiveness to promote a business-friendly environment by inviting the chairs of the US, the EU and Japanese business associations to Korea as committee members.

Mr Lee has already established a hotline to allow major foreign investors to share their advice and complaints directly with the presidential office. The Council has implemented a fast-track approval process for authorising industrial zones, which Korea needs for domestic and foreign investors. The Council has also taken steps to minimise existing impediments such as a slow, laborious FDI approval process.

It should be noted that Korea’s ongoing multi-track free trade agreement negotiations are a strong indication that the government is prepared for head-on competition in a fully liberalised global economy. National competitiveness derives from how efficiently a country can use outsourcing across national borders. In retrospect, Korea has always responded to serious challenges in a unified and impressive manner. With the government determined to make Korea an advanced nation, Koreans must develop a truly open mind to welcome a global flow of investment. Most importantly, Koreans must accept, as an iron-clad business rule, that economic benefits are always a two-way street.

Investor preferences

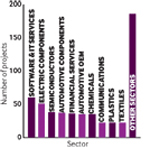

As for investor preferences, manufacturing still accounts for the lion’s share, with a total of 164 projects from January 2003 to July 2008, representing 30% of the total, according to fDi Intelligence. However, manufacturing, as the top business activity, may find itself challenged by design, development and testing, which recorded the highest growth at 46% a year on average in this period, according to the same source. There is no doubt that the leading sector remains software and IT services, which accounted for 11% of projects, a tribute to Korea’s skilled labour force, innovation skills and technology infrastructure. By source country, the US leads the pack with 211 projects in the past five years, Japan is in second place (with 93) and Germany third (57), while France and the UK trail with 38 and 29, respectively.

However, it was the UK’s Tesco that recently announced a mega-investment in the Korean market with its acquisition of 36 Homever stores from the E-Land Group, for a total of £958m ($1.74bn), including existing debt. This is Tesco’s largest-ever investment outside the UK. The Homever stores, most of which were formerly Carrefour hypermarkets, have a total sales area of 280,000 square metres, plus a further 120,000 square metres of adjacent shopping mall space.

The acquisition and conversion of these large hypermarkets, 20 of which are in the Greater Seoul and Gyeonggi metropolitan area, will strengthen Tesco Homeplus’ position in the market. “After nine years of successful development in Korea, Samsung Tesco is now a substantial business and our leading international operation,” says Tesco CEO Terry Leahy. “This acquisition of high-quality assets is an important strategic move, which will allow us to accelerate our growth in this key market and deliver a much stronger offer for customers as we convert the stores to Homeplus. It also demonstrates our continued commitment to invest into Korea.”

Tesco, the world’s third largest food retailer, will also invest £50.6m to set up a logistics centre in Korea.

COUNTRY PROFILE:

KOREA

Population: 48.4 million

Pop. growth rate: 0.269%

Area: 98,190 sq km

Real GDP growth: 5%

GDP per capita: $24,800

Current account: $5.954bn

Largest sector (% of GDP): Services 57.6%

Labour force: 24.22 million

Unemployment rate: 3.3%