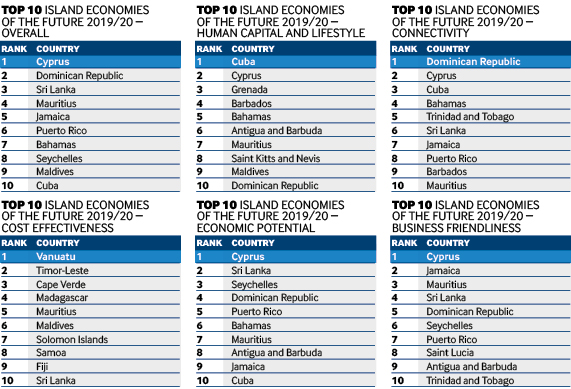

Cyprus is ranked in first place in fDi’s second biennial Island Economies of the Future ranking, with the Dominican Republic retaining its second place and former top-placed Sri Lanka nudged into third position.

Further reading:

Advertisement

Sri Lanka retains crown as fDi’s most diversified island economy

Click here to download a PDF of the rankings:

Between 2014 and 2018, Cyprus recorded 153 outward FDI projects, according to greenfield investment monitor fDi Markets. The south European island nation had the highest level of outward FDI of all locations in the study, with its top five investing companies accounting for more than three-quarters of all capital investment from Cyprus’s outward FDI in the time analysed. Karo Resources, a mining company based in the south-western city of Paphos, invested in a platinum mine in Zimbabwe in May 2018, at a cost of $4.2bn. The project will comprise a coal mine and a 300-megawatt solar power station.

Cyprus enjoys an innovative culture, recording more than 130 patents between 2008 and 2017, according to the United States Trade and Patent Office. This was a contributing factor to the country’s first place ranking for Economic Potential. Cyprus also boasted the highest number of companies in the knowledge-based sector on a per capita basis, which with high FDI job creation per capita and low rates of corporation tax, put it first for Business Friendliness. Investors in Cyprus can start a business in six days and the country scores well on various indices, including the Index of Economic Freedom from the Heritage Foundation and the World Bank’s Ease of Doing Business Ranking.

Dominican rebound

Dominican Republic, which ranks second overall, enjoys a healthy economy with relatively low unemployment rate of 5.2% and an average annual GDP growth rate of more than 5% between 2014 and 2018.

Advertisement

The country has experienced a rebound in FDI since the 48% decline in project numbers between 2014 and 2015. Since then, it has experienced year-on-year growth in project numbers, reaching a peak in 2018 with 22 investments. Investment in the hotels and tourism sector has mirrored the overall investment pattern, increasing steadily since 2015 after a decline between 2014 and 2015. Between 2014 and 2018, hotels and tourism accounted for more than 40% of all investment into the country. The country boasts three ports and performs well on the World Bank’s Liner Shipping Connectivity Index, while six international airports bring passengers from 69 destinations around the world, helping its first-place ranking in Connectivity.

Sri Lanka is ranked third in this year’s study, also ranking second for Economic Potential, fourth in Business Friendliness and sixth for Connectivity. Eighteen investors chose to expand operations in the country between 2014 and 2018, the most of any location. In August 2018, UK-based Chartered Institute for Securities & Investment announced its expansion in Colombo, crediting the expansion decision to the country’s “highly educated, English speaking, service- oriented, adaptable workforce”.

Leading island economies' FDI strategies

Dominica

Dominica endured major damage during September 2017’s Hurricane Maria. Invest Dominica Authority has been at the forefront of the country’s recovery, with an FDI strategy centred on BPO, eco-tourism and manufacturing. The government agency has increased training in strategic social media use to better reach potential investors and will soon launch a new website to provide easier access to information. The local government has implemented an island-wide programme to repair roads and replace bridges affected by the hurricane and talks are under way for a larger cargo port and a new international airport.

Cyprus

Invest Cyprus’s FDI strategy focuses on a range of sectors, including ICT, education and film making. The agency offers a range of corporate tax incentives while all companies are subject to a corporate tax rate of 12.5%, one of the lowest in Europe. Invest Cyprus co-operates with international consultants and media groups on promotional campaigns across target markets and recently launched websites for its Study in Cyprus and Launch in Cyprus initiatives. Applied research is encouraged by way of EU and national funding and an attractive intellectual property box is in place for new companies and investors. The agency also encourages companies to set up their international and regional headquarters in Cyprus, highlighting its geostrategic location between three continents.

Trinidad and Tobago

Trinidad and Tobago's national investment promotion agency, InvestTT, aims to improve burgeoning activities in sectors such as manufacturing, ICT, maritime services, tourism, agribusiness and creative industries. One its main initiatives is Tamana InTech Park, where it collaborates with other state agencies to attract ICT and manufacturing investment. The agency also hosts events to attract FDI and attends numerous summits and conferences to promote it. InvesTT redesigned its website in November 2017 and employs video testimonials, a proactive social media strategy and online advertising.

Barbados

Invest Barbados continues to review and strengthen its marketing strategy, building awareness of the country's international business sector. It is expanding into new and existing markets through seminars and road shows, as well as hosting educational and industry conferences with local professionals. It is currently upgrading its website to be more interactive and user friendly, and offers an active customer care programme to address client concerns and potential roadblocks. Medical tourism remains a focus for the island, which has three international medical schools with another four expected to open shortly.

Jamaica

The Jamaica Promotions Corporation (Jampro) employs more than 100 staff in its Kingston headquarters; a regional office in St James; and international branches in New York, Toronto and London. In January 2019, the government signed a $15m agreement with the Inter-American Development Bank in a bid to encourage growth in higher value-added digital segments. The five-year Global Services Sector Project will be executed by Jampro and aims to create 50,000 jobs by 2023 and increase the value of exports of global services by 2.6% by 2024.

Saint Lucia

The lion’s share of Saint Lucia’s inward FDI is in the tourism sector. The island’s economic development body, Invest Saint Lucia, offers access to several fiscal incentives including a tax holiday of up to 15 years, an export allowance and unrestricted repatriation of profits and capital. The agency also recently hosted a BPO showcase for potential investors. Several infrastructure developments are in progress and Saint Lucia recently broke ground on a highly anticipated redesign of Hewanorra International Airport, estimated to be worth $175m.

Grenada

Tourism forms the cornerstone of the Grenada Investment Development Corporation’s FDI strategy. In recent years, the country has seen a significant increase in new resorts, hotels and marinas, as well as an expansion of community-based tourism products and services, product enhancements and marketing. Investment opportunities can also be found in agribusiness, education, health, ICT and energy. In 2019, GIDC will unveil several new marketing initiatives aimed at attracting greater investment, which include billboard advertisements, a new promotional video and website upgrade. It will also participate in regional and international conferences, trade shows and expositions, and host investment webinars with potential foreign investors.

Methodology

To create a shortlist for fDi’s Island Economies of the Future 2019/20, the fDi Intelligence division of the Financial Times collected data using the specialist online tools fDi Markets, which tracks greenfield FDI projects that have been announced, and fDi Benchmark. In total, 31 island economies were analysed for the study. Data was then collected for these locations under five categories: Economic Potential, Business Friendliness, Human Capital and Lifestyle, Cost Effectiveness and Connectivity. Locations scored up to a maximum of 10 points for each datapoint, which were weighted by importance to the FDI decision making process in order to compile both the subcategory rankings as well as the overall ‘Island Economies of the Future 2019/20’ ranking.