Vilnius takes first place in fDi’s first Tech Start-up FDI Attraction Index. The Lithuanian capital is the inaugural winner of the new study by fDi Intelligence, receiving the highest number of greenfield FDI projects per capita from start-ups in the software and IT services sector between 2016 and 2018.

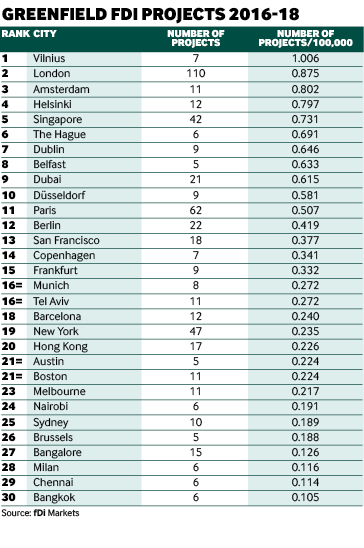

Vilnius attracted 1.006 greenfield FDI projects per 100,000 inhabitants, putting it firmly at the top of the Tech Start-up FDI Attraction Index 2019, followed by London (0.875), Amsterdam (0.802), Helsinki (0.797) and Singapore (0.731).

Advertisement

While larger cities often attract larger numbers of inbound projects, including from start-ups, it is important to measure success on a per-capita basis, as tech start-ups often engage in talent-seeking FDI as they expand internationally. “Tech companies expand internationally for two major reasons: to enter a new market and to source new talent,” says Patrick de Laive, co-founder of TNW, a media, events and intelligence company focused on new technology and start-ups.

European appeal

Europe is the most attractive region for tech start-up investments, home to eight out of the top 10 cities and more than half of the top 30.

London ranks second in the index and attracted the most greenfield FDI projects (110), which made up 11% of the 997 projects included in the ranking. This figure was more than 75% higher than Paris, which attracted the second highest number of tech start-up projects (62). The UK capital has long been an attractive location for tech start-ups due to the large pool of venture capital available in the city, strong clusters and impressive tech talent pool.

Germany and the US have the highest number of cities in the top 30, yet there are no US cities in the top 10. Düsseldorf attracted 0.581 greenfield FDI projects per 100,000 inhabitants from tech start-ups between 2016 and 2018, ranking 10th overall and the highest among German cities.

Berlin, which attracted 22 projects from tech start-ups, ranks in 12th place overall due its relatively higher population, while Frankfurt and Munich are 15th and 16th, respectively, with 0.332 and 0.272 projects per 100,000 inhabitants. The Netherlands has performed particularly well, with two cities (Amsterdam and The Hague) in the top 10 – a feat only matched by the UK – showing how a consistent strategy pays off in terms of attracting tech start-ups. “Having a clear and consistent long-term start-up strategy, such as the one implemented across the Netherlands, is key to ensuring the development of homegrown companies and the attraction of investment from foreign tech companies,” says Mr de Laive.

Advertisement

Dubai's regional lead

In the Middle East and Africa, only Dubai makes it into the top 10, having attracted 21 greenfield FDI projects from tech start-ups in the review period, at a rate of 0.615 projects per 100,000 inhabitants. Tel Aviv ranks 16th alongside Munich at a rate of 0.272 greenfield projects per 100,000 inhabitants, as the Israeli capital continues to prove its mettle as a hub for start-ups in the Middle East.

Nairobi is the only city in Africa to make the top 30, as the Kenyan capital (and fifth largest city in Africa by population) attracted 0.191 tech start-up greenfield projects per 100,000 inhabitants. Kenya is one of the leading tech hub countries in Africa – boasting almost 50 tech start-ups – and is part of the so-called ‘innovation quadrangle’ of countries, together with Nigeria, South Africa and Egypt, according to a 2019 mapping by mobile network operator trade body GSMA and think tank Briter Bridges.

No cities from Latin America or the Caribbean feature in this year’s top 30 tech start-up cities. However, Colombian capital Bogotá attracted four greenfield projects from tech start-ups between 2016 and 2018, meaning it just missed out on inclusion. Nonetheless, the city has made real strides towards fostering domestic start-ups, and attracting tech start-ups from foreign countries through infrastructure spending and recent tax reforms.

Sources of success

Most tech start-ups included in this index are based in a handful of cities. The top 20 source cities accounted for more than 50% of the 997 investments, while 46.3% of the 674 tech start-ups included in the index were based in these cities. The top five source cities were London, New York, Singapore, San Francisco and Barcelona, all of which feature both in the top 30 of this index and the top 30 global start-up ecosystems featured in the 2019 Global Startup Ecosystem Report produced by Startup Genome, a Silicon Valley-based innovation policy advisory firm focused on start-up ecosystem development.

“The cities that attract the most FDI from expanding tech companies are also those that have their own homegrown tech startups,” says Arnobio Morelix, chief innovation officer at Startup Genome.

Beyond important factors such as talent, funding and having experienced entrepreneurs, there are also less obvious factors that are crucial to the success of start-up ecosystems in fostering homegrown companies and attracting greenfield investment from foreign tech start-ups.

“Global connectedness – a measure of the extent to which local founders have relationships and partnerships with other top ecosystems across the world – is important as it can lead to greenfield foreign investment, it attracts knowledge, talent and capital to a location, and it helps companies in those places to start with a more global mindset,” says Mr Morelix.

Prolific projects

Of the 674 tech start-ups included in the ranking under fDi’s broad definition, the most active investor was Barcelona-based Glovo App, which connects customers with independent local couriers. It undertook 20 greenfield projects.

Singapore-based AnyMind Group, which offers business solutions powered by AI, ranks second thanks to its 16 greenfield projects, while San Francisco-based InSpeed Networks – which has a technology that improves network performance – invested $284.6m overall, the most of any tech start-up.

Given the potential rewards from tech start-ups, as shown by the estimated $7.38bn of greenfield investment they were responsible for between 2016 and 2018, it is imperative that cities implement effective strategies to promote investment from this new generation of companies. Moreover, tech start-ups bring other benefits including raising a city’s brand image, attracting tech talent and knowhow, and fostering further development of other homegrown software-based start-ups.

Key considerations of tech companies wanting to expand internationally are “work-life balance and quality of life, as many people want to reside in affordable and liveable cities”, says Mr de Laive. “Talent will not necessarily move to you,” he adds.

Why Vilnius?

Vilnius, the winner of fDi’s 2019 index, has a clear strategy for attracting tech start-ups through a focus on emphasising its business-friendly regulatory environment and open data policy (which makes most municipal data open to the public and free to use by tech start-ups) and helping new companies integrate into the city.

“One of the crucial steps of attracting talent or business to the city is providing a helping hand for them in the integration process. Vilnius puts considerable effort into welcoming and helping start-ups grow in the city by providing relocation and soft-landing services and tailored aftercare,” says Inga Romanov-Skiene, director of Go Vilnius, the city's investment promotion agency.

Greenfield investment by tech start-ups has been on the rise in terms of both projects and capital expenditure, going from $1.27bn invested in 192 projects in 2016 to $2.43bn invested in 335 projects in 2017, and finally to $3.68bn invested in 470 projects in 2018, according to data from greenfield investment monitor fDi Markets. This increase has coincided with the rise of venture capital funding, which reached a decade high of $220bn in 2018 according to Startup Genome, implying significant potential for the development of many future tech start-up ecosystems.

“We expect that there will be 30 Silicon Valleys in the future – not as big as the present one, but each with critical mass and creating meaningful economic impact. While they cannot necessarily compete across the board with established ecosystems such as Silicon Valley, these emerging ecosystems can be very competitive on specific start-up subsectors or in specific regions of the world,” says Startup Genome’s Mr Morelix.

Methodology

The Tech Start-up FDI Attraction Index 2019 measures at the city level the number of greenfield FDI projects made in the software and IT services sector per 100,000 inhabitants. Greenfield FDI project data used in the index is sourced from fDi Markets, a database from fDi Intelligence which tracks crossborder greenfield investment, and excludes retail investments. The ranking included 997 greenfield investments made between 2016 and 2018 by 674 tech start-up companies across 231 cities. For a company to be considered a tech start-up and included in the index it had to be in the software and IT services sector and founded since 2014. Cities had to attract at least five greenfield projects from 2016 to 2018 to be included in the index. Population data was collected from fDi Benchmark where possible, which uses national statistics and includes metropolitan areas. Where unavailable the most up-to-date population figures were collected from City Population.