In June 2016, the UK voted to leave the world’s largest trading bloc, ending decades of co-operation on economic and regulatory matters that covered everything from trading and finance to product safety. In March 2019, the UK will officially leave the EU and no one knows yet quite how this will look. Prime minister Theresa May’s cabinet is reportedly preparing a ‘no deal’ scenario, one in which the UK leaves with no agreement with the remaining 27 EU members on trade, security, immigration or the infamous ‘divorce settlement’.

More stories from the ranking

- fDi’s European Cities and Regions of the Future 2018/19 – Cities

- fDi’s European Cities and Regions of the Future 2018/19 – Regions

- fDi’s European Cities and Regions of the Future 2018/19 – FDI Strategy (Cities)

- fDi’s European Cities and Regions of the Future 2018/19 – FDI Strategy (Regions)

- fDi’s European Cities and Regions of the Future 2018/19 – LEPs

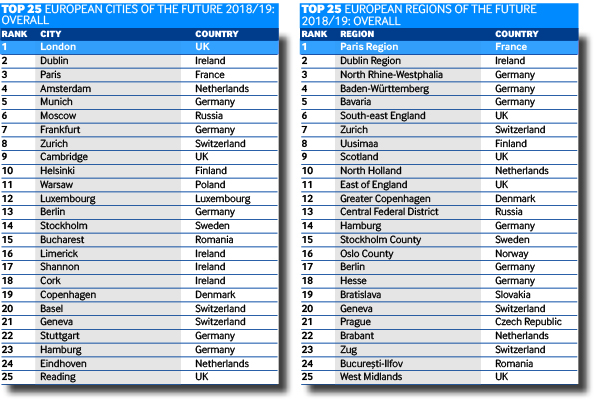

fDi’s European Cities and Regions of the Future 2018/19 ranking seeks to find the most promising cities and regions across the whole of Europe, not just those that belong to the EU. Since the UK's vote to leave, many companies have made investment decisions that suggest they see a future in the UK. In October 2016, Netherlands-based ING announced it was to create 60 jobs in London, which would be relocated from Belgium and the Netherlands. The finance group stated that even in the light of Brexit, the city still had plenty to offer investors by way of talented workforce.

Advertisement

Other companies see the advantages offered by the uncertainty of the Brexit process. Australia-based mineral and exploration company Peak Resources stated that the expected devaluation of the pound made operating costs more affordable, and any UK efforts to maintain (and potentially improve) its competitiveness on a world stage in a post-Brexit age could present investors with opportunities. In establishing its manufacturing facility in the UK in December 2016, Peak Resources joined a chorus of investors from Amazon to Snapchat who continue to sing the UK’s praises.

With a cautious note, we bring you this year’s European Cities and Regions of the Future ranking for 2018/19. Politics and personalities could change dramatically before March 2019; however, London will remain a very important city to watch and, we believe, a City of the Future. That said, its FDI competitors that remain in the EU are closing ranks on it, and will have many strong hands to play as uncertainties test London’s durability as Europe’s premier investment destination.

Here, we present our current findings on the top cities and regions for FDI attractiveness in Europe.

Methodology

To create a shortlist for fDi European Cities and Regions of the Future 2018/19, the fDi Intelligence division of the Financial Times collected data using the specialist online FDI tools – fDi Benchmark and fDi Markets as well as other sources. Data was collected for 489 locations (301 cities, 150 regions and 38 LEPs) under five categories: Economic Potential, Labour Environment, Cost Effectiveness, Infrastructure and Business Friendliness. Locations scored up to a maximum of 10 points for each data point, which were weighted by importance to the FDI decision-making process in order to compile the subcategory rankings as well as the overall ‘European Cities and Regions of the Future 2018/19’ ranking.

In addition, surveys were collected under a sixth category, FDI Strategy, for which there were 146 submissions. In this category, locations submitted details about their strategy for promoting FDI, which was then scored by fDi’s judging panel.

Advertisement

In a departure from the methodology of recent rankings, bonus points were awarded to locations ranking in the top 10 for FDI Strategy within their population brackets. The highest ranking location was awarded an extra one point, on a sliding scale to 10th position, which was awarded an additional 0.1 point. Bonus points contributed to the scores for the overall results tables, but not the five categories mentioned above.

Click on the link below for a PDF version of the complete results:

To download the press release, please click below: