The Regional Comprehensive Economic Partnership (RCEP) signed on November 15 is set to challenge the EU as the world’s largest investment bloc, as it promises to foster integration among 15 Asia-Pacific countries representing a third of the global population and output.

Intra-RCEP cross-border investment (investment into a member country by a company belonging to another member country) generated 14,000 greenfield projects between 2003 and September 2020, according to figures from investment monitor fDi Markets. That is higher than any other trade and investment bloc except for the EU, with 37,991 intra-European projects announced since 2003, according to fDi Markets figures.

Advertisement

Investment value estimates offer another perspective, though, as from this perspective the RCEP bloc already exceeds the EU as the largest investment area in the world, fDi Markets figures show.

RCEP is a very diverse bloc bringing together 15 countries at very different stages of economic development, from Japan and South Korea all the way to Laos and Cambodia.

“This diversity between advanced economies and less developed economies creates a huge complementarity in the region, and complementarity generates opportunities,” James Zhan, senior director for investment and enterprise at Unctad, tells fDi.

“Besides, there are specific provisions to support the least developed countries (Laos, Cambodia and Myanmar). They will benefit a lot.”

Japanese companies have historically been the main source of greenfield investment in the region, followed by their peers in South Korea, Singapore and China, whose companies have been increasing their footprint in the region in the past years, according to fDi Markets figures.

However, China has been the largest recipient of intra-regional foreign investment, with Vietnam and Thailand following at distance, fDi Markets figures show.

Advertisement

Expectations are for the deal to add $200bn annually to the global economy by 2030, also by fostering intra-RCEP investment.

The agreement has a specific article dedicated to investment promotion that urges the member country to promote and increase awareness of the region as an investment area including through: “encouraging investments among the parties”; “organising joint investment promotion activities between or among parties”; “promoting business-matching events”; “organising and supporting the organisation of various briefings and seminars on investment opportunities and on investment laws, regulations, and policies”; “and conducting information exchanges on other issues of mutual concern relating to investment promotion”.

“Many of such measures can already be found in existing regional agreements like Asean. They have also been promoted in UNCTAD’s Global Menu for Investment Facilitation over the past years,” Mr Zhan adds.

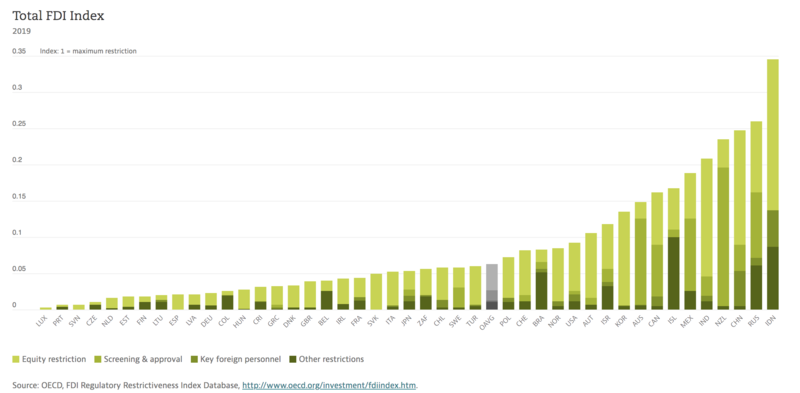

RCEP’s emphasis on deeper investment integration is particularly meaningful as the bloc brings together some of the world's most FDI restrictive countries. According to 2019 OECD data, Indonesia is the country with the most restrictive foreign investment environment in the whole world. China (the 3rd most restrictive FDI environment), New Zealand (4th) and South Korea (10th) also feature in the top 10. Japan fares better, although the country’s sophisticated business and cultural environment has often kept foreign investors at bay. If RCEP is a breakthrough towards better investment integration among Asia-Pacific countries, the road ahead remains uphill.