The European data centre market is set to experience its “biggest growth phase” yet, as demands for power push investors to expand beyond the continent’s core markets.

On September 11, Australia’s largest pension fund, AustralianSuper, announced that it is investing €1.5bn to acquire a significant minority stake in Vantage Data Centers’ operations in Europe, Middle East and Africa. This follows the news that UK-based digital infrastructure provider Virtus Data Centres announced on September 4 that it will invest €3bn in a data campus in Berlin, Germany.

Advertisement

Scott Newcombe, head of data centre advisory for Europe, Middle East and Africa at real estate services firm Savills, tells fDi that both acquisitions and direct investments of this kind are just “the tip of the iceberg”.

“We have mandates from several hyperscalers and operators looking to serve as hyperscalers where they’re looking for sites of 100 acres with 300 to 500 megawatts of capacity,” he says.

According to real estate services company JLL, the core data centre markets of Frankfurt, London, Amsterdam, Paris and Dublin are expected to grow by a record 17% this year, as tier two markets like Berlin and Madrid come to the fore.

Due to the rising demand for cloud computing and the forecast adoption of artificial intelligence (AI), Mr Newcombe says that this is going to be “the biggest growth phase in Europe in terms of investment, even taking into account the advent of cloud five to seven years ago”.

This mostly has to do with the ways that hyperscalers — cloud providers such as Microsoft, Google or Meta — are deploying their technology.

Traditionally, these companies have invested in one hub which then serviced the entire region. Now, with more demand for their services, cloud providers are looking to invest in multiple sites, including in smaller data centres located close to the edge of a network. This is driven by power constraints in key centres, such as London or Amsterdam, and problems related to latency, or the lag between data passing from one point on a network to another.

Advertisement

“This means that what was London is now going to be Manchester, Leeds and Cambridge; what was Frankfurt is now going to be Berlin, Munich and Hamburg,” Mr Newcombe says, adding that there’s also “a bleed into eastern Europe” into cities like Prague, Bucharest and Budapest.

“One client said to us: ‘We don’t care about the location. We care about where the power is’,” Mr Newcombe adds.

More on data centres:

Richard Clifford, director of solutions at consultancy Keysource, says that in Europe’s core data centre markets investors looking for power availability could be waiting up to 10 years due to constraints on the grid.

US tech company Microsoft is reported to have bought nearly seven hectares of land from the CPI group in Prague earlier this year amid rumours that it will build a data centre there, according to Czech news service Seznam Zprávy.

As the industry grows in volume and spreads across different countries, its demands for power increase, which in turn has spurred on regulatory moves on the part of the EU to regulate the efficiency of energy performance.

“In Europe, the industry is now being driven by regulation, which is driving sustainability initiatives,” Mr Clifford says, as companies look more carefully at elements ranging from the selection of raw materials for construction to the carbon footprint of transportation and the use of heat pumps.

“It’s gone from being almost an unregulated industry to now being at the precipice of proper regulation,” he says. “To all intents and purposes, data centres are an unrecognised utility. Data is something we live and breathe.”

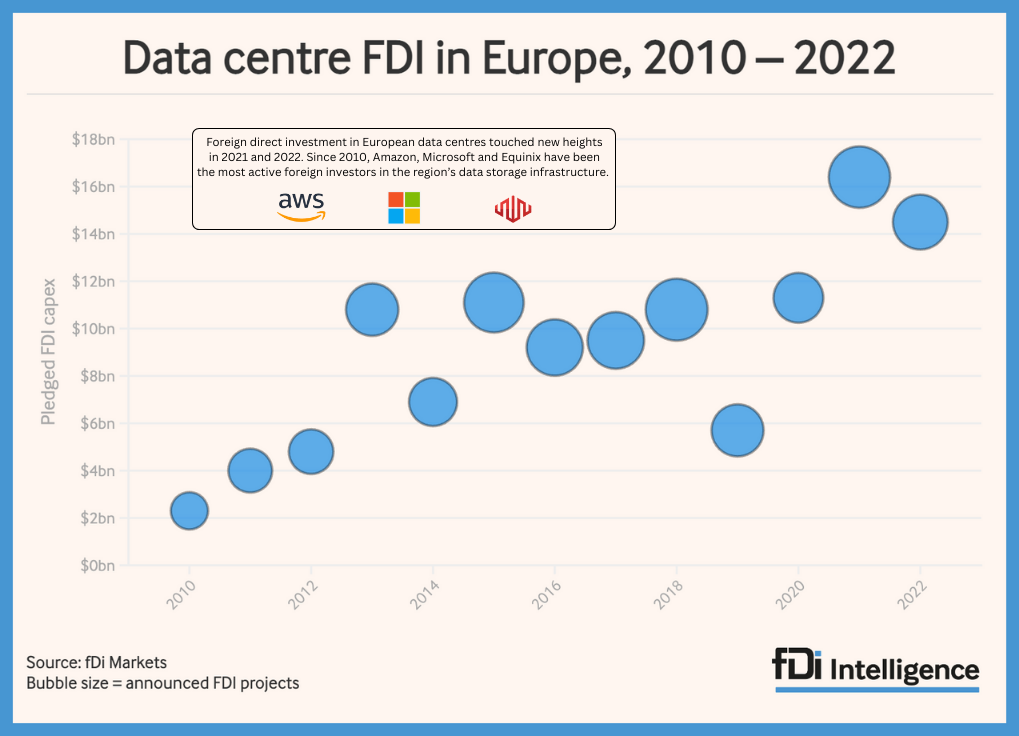

Globally, foreign investors have poured an estimated $33.4bn into data processing, hosting and related services globally so far this year, according to fDi Markets, up by roughly 48% on the same period last year and more than double compared with the first seven months of 2020.